Microsoft Corporation is listed on the Nasdaq Stock Market, a prominent exchange for technology and innovation-driven companies. Satya Nadella serves as the key executive, holding the positions of Chairman of the Board and Chief Executive Officer. Operating within the technology sector, Microsoft is a major player in the software and IT services industry. The company boasts a significant workforce, with a total of 221,000 employees contributing to its diverse range of operations. Microsoft was incorporated in 1993, marking the beginning of its journey as a global technology giant.

Business Segments:

Microsoft Corporation is a global technology company that develops and supports software, services, devices, and solutions. The company operates through three main segments:

Productivity and Business Processes: Includes products and services related to productivity, communication, and information services. Key components are Office Commercial, Office Consumer, LinkedIn, and Dynamics business solutions.

More Personal Computing: Primarily involves Windows, devices, gaming, and search and news advertising.

Financial Performance:

Microsoft Corporation exhibits robust figures, including a staggering market capitalization of $2,887.21 billion USD. The Price-to-Earnings (P/E) ratio for the trailing twelve months stands at 37.61, indicating a healthy balance between the stock price and earnings. The company offers a dividend with a yield of $3.00 and 0.77%.

For the third quarter of 2023, Microsoft reported a substantial revenue of $56.52 billion, reflecting an impressive 12.80% year-over-year growth. The net income for the same period reached $22.29 billion, showcasing a remarkable 27.00% year-over-year increase. The Earnings Per Share (EPS) for the trailing twelve months is reported at $10.33. Additionally, Microsoft has a significant public float of 7.32 billion shares.

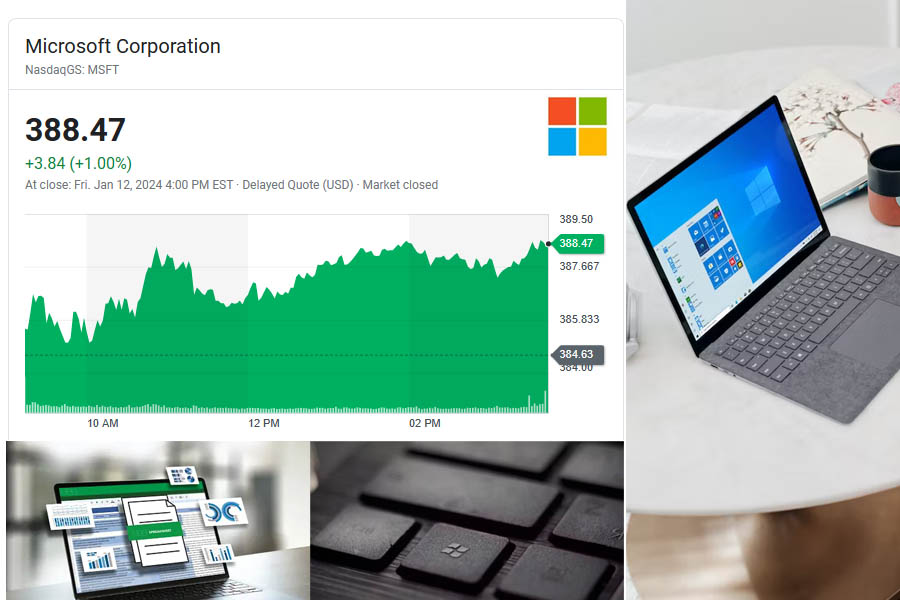

Share Price Development:

As of January 12, 2024, Microsoft Corp's share price on the NASDAQ stock market stands at $388.47. This reflects a slight increase from the previous closing price of $384.63. Over the past 52 weeks, the stock has demonstrated a range of performance, with a low price of $230.68 and a high price of $390.68. The current share value indicates the company's resilience and its ability to navigate market fluctuations, showcasing a positive trajectory in its stock price development.

Investor Confidence and Analysis:

Microsoft's strong financial performance has bolstered investor confidence, with a market capitalization of $2.89 trillion.

The P/E ratio reflects a healthy balance between stock price and earnings, suggesting a positive outlook.

Dividend yield provides investors with a steady income stream, showcasing Microsoft's commitment to shareholder value.

Q3 2023 results exhibit substantial year-over-year growth in revenue and net income, affirming the company's strategic positioning.

Target Price:

Analysts project a positive trajectory for Microsoft, with a continued upward trend in the stock price. While exact target prices may vary, the company's consistent growth suggests a favorable outlook.

Microsoft Corp on the Nasdaq Stock Market stands as a technology powerhouse, with a diversified business portfolio, strong financials, and visionary leadership under Satya Nadella. As it continues to evolve in response to industry trends, Microsoft remains a key player in the global technology landscape, offering investors stability and growth potential.