Global Business News: Financial Markets Insights

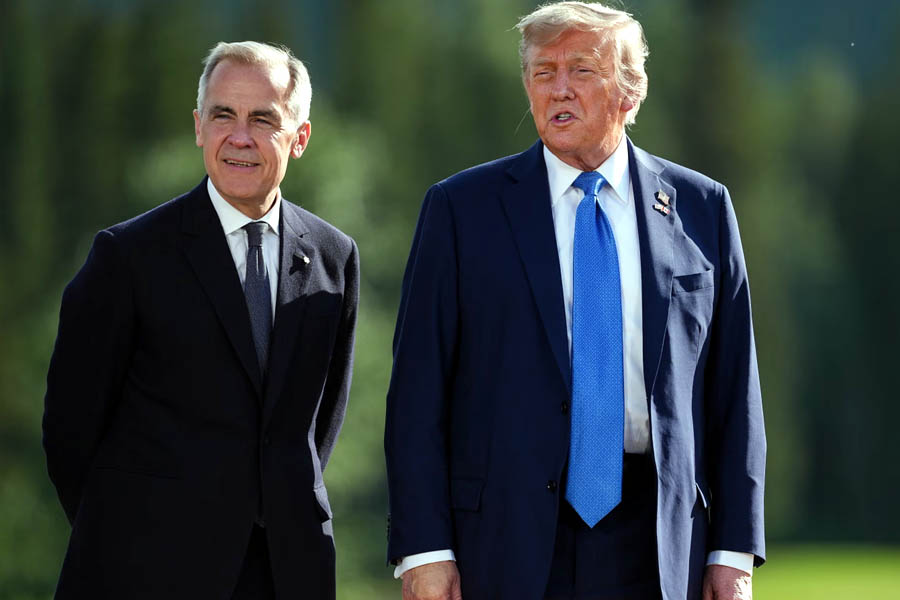

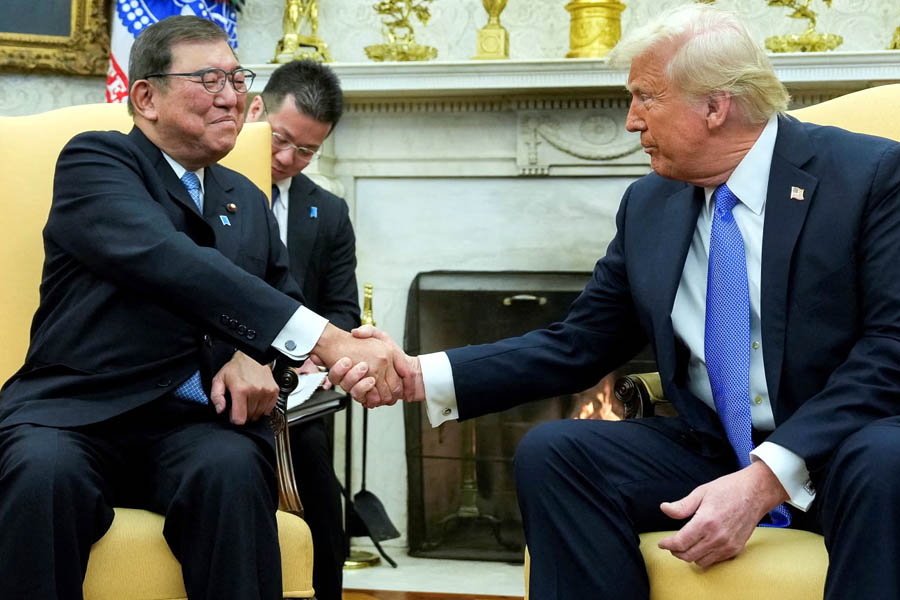

U.S. President Donald Trump hosts German Chancellor Friedrich Merz for a bilateral meeting at the White House in Washington, United States, March 3, 2026.

🔥 Oil Shockwave 2026: US-Israel War on Iran Sends Brent to $81.40, Gas Soars 40% as Strait of Hormuz Chokes Global Trade 🌍🛢️

4-March-2026: Global energy markets are reeling after the escalating conflict between 🇺🇸 United States and 🇮🇱 Israel against 🇮🇷 Iran disrupted critical Middle East oil and gas flows. Tehran’s attacks on ships and energy facilities, combined with the effective closure of navigation through the Strait of Hormuz, have forced production stoppages from 🇶🇦 Qatar to 🇮🇶 Iraq. The region accounts for nearly one-third of global oil production and almost one-fifth of natural gas output — making the disruption a direct threat to worldwide energy security and inflation stability. 🛢️⚡

Benchmark Brent crude surged $3.66 — up 4.7% — settling at $81.40 per barrel, its highest close since January 2025. European natural gas prices spiked as much as 40%, adding to earlier weekly gains. Agricultural commodities such as sugar, fertiliser and soybeans also climbed, amplifying fears of a broader inflation shock that could stall fragile economic recoveries across 🇪🇺 Europe and 🇯🇵 Asia. 📈🌾

President Donald Trump signaled a more aggressive US response, stating the US Navy could begin escorting oil tankers through the Strait of Hormuz if necessary to secure global supply routes. He also directed the US International Development Finance Corporation (DFC) to provide political risk insurance and financial guarantees for maritime trade in the Gulf — blending financial leverage with military deterrence to stabilize crude markets. 🚢🛡️

“No matter what, the United States will ensure the free flow of energy to the world,” Trump declared, underscoring that lower fuel costs remain central to his economic messaging. However, shipping analysts remain skeptical that naval escorts and DFC guarantees alone can immediately cool volatile prices amid rising geopolitical risk premiums. 💬🌎

The conflict intensified following joint US-Israeli strikes over the weekend targeting Iranian military infrastructure. At an Oval Office press conference alongside visiting German Chancellor Friedrich Merz 🇩🇪, Trump addressed questions about the potential “worst-case scenario” following the assassination of Iran’s supreme leader, Ayatollah Ali Khamenei. Trump expressed confidence in US-Israeli military superiority but acknowledged uncertainty over who might ultimately take power in Tehran. ⚖️🔥

Meanwhile, regional tensions deepened after a suspected Iranian drone struck the CIA station at the US embassy in Riyadh 🇸🇦, causing limited damage. The US military also confirmed it had destroyed 17 Iranian vessels, including a submarine, and struck nearly 2,000 targets inside Iran, according to the commander of US Central Command. 🛰️⚔️

Asian markets reacted sharply. Tokyo’s Nikkei 225 fell 1.7% in early trading, while Seoul’s Kospi slid another 3.1% after a steep 7.2% drop a day earlier. Wall Street futures suggested a flat open, but volatility remains elevated as investors closely monitor developments in the Gulf and potential US naval deployment. 📉🌏

With the Strait of Hormuz — one of the world’s most strategic energy arteries — effectively constrained, traders warn that a prolonged conflict could ignite sustained price spikes, reignite global inflation, and reshape energy diplomacy in 2026. The world now watches whether military containment efforts can prevent a full-scale economic shock. 🌍💥

ENERGY CRISIS 2026 STRAIT OF HORMUZ GLOBAL INFLATION RISK MIDDLE EAST CONFLICT OIL PRICE SURGE

Map highlighting the strategic Strait of Hormuz between 🇮🇷 Iran and 🇴🇲 Oman, the vital maritime corridor through which nearly 20% of the world’s oil supply passes, now at the center of escalating tensions following US–Israel strikes and Iranian threats to shipping.

🛢️ Oil Shockwave: 🇮🇷 Iran War Triggers 13% Brent Surge as Strait of Hormuz Faces Shutdown Threat 🚨🌍

2-March-2026: Global energy markets were thrown into turmoil after intense 🇺🇸🇮🇱 US–Israel strikes on 🇮🇷 Iran sparked fears of a major supply disruption through the Strait of Hormuz — the world’s most critical oil chokepoint. Brent crude surged by as much as 13% in early trading, briefly hitting $82 per barrel, its highest level in 14 months. Though prices later eased, Brent remained up about 4%, signaling persistent volatility. ENERGY ALERT 🛢️📈

The Strait of Hormuz — responsible for nearly one-fifth of global oil and seaborne gas shipments — is now at the center of geopolitical anxiety. Within hours of the weekend strikes, Tehran reportedly warned tankers that passage through the strait would not be permitted. Two vessels were attacked, one near 🇴🇲 Oman and another off 🇦🇪 the United Arab Emirates, according to the United Kingdom Maritime Trade Operations. Marine tracking services showed oil tankers stacking up on both sides of the narrow waterway as insurers and operators reassessed risk. STRAIT CRISIS ⚓🔥

Stock markets reacted sharply. 🇯🇵 Tokyo’s Nikkei 225 fell nearly 2.4% before trimming losses to 1.5%, while 🇦🇺 Australia’s ASX 200 dipped 0.4% and 🇨🇳 Shanghai’s CSI 300 slid 0.6%. Pre-market signals pointed to a weaker open on Wall Street as investors weighed the broader economic fallout. Meanwhile, gold — the traditional safe-haven asset — climbed 2.8% to $5,397.10 per ounce as traders sought protection from escalating conflict risk. SAFE HAVEN RUSH 💰✨

Shipping giant Maersk announced it would halt passage through both the Strait of Hormuz and the Suez Canal, citing safety concerns. The International Maritime Organization urged vessels to avoid the region, warning of injuries to seafarers and heightened maritime threats. With roughly 15 million barrels of crude per day passing through Hormuz, analysts warn that even a temporary closure could trigger a severe supply squeeze and renewed inflation pressures worldwide. 🌐⚠️

Iran, which accounts for about 4.5% of global oil production and remains a key member of the OPEC+ alliance, faces potential export disruption. Although OPEC+ agreed to a modest output increase of 206,000 barrels per day for April, much of that supply must still transit the Gulf. Analysts say unless de-escalation emerges quickly, markets could see further upward repricing of oil — amplifying risks to global growth and financial stability. GLOBAL MARKET WATCH 🌍📊

As military operations between 🇺🇸🇮🇱 and 🇮🇷 show no signs of slowing, the energy shock rippling from the Middle East is rapidly becoming a worldwide economic test — with oil, shipping lanes, and investor confidence all hanging in the balance. 🚀🛑

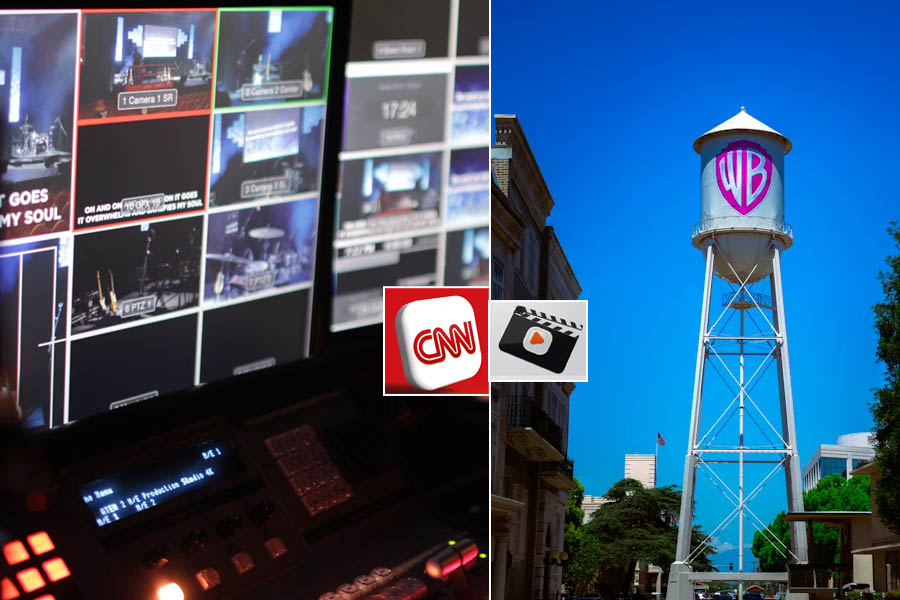

Netflix withdraws its $82.7bn bid for Warner Bros Discovery, paving the way for Paramount Skydance’s enhanced $31-per-share takeover offer.

🎬 Netflix Walks Away from Warner Bros Deal 🇺🇸 | Paramount Skydance Set for $31-Per-Share Victory in Hollywood Showdown 💰🔥

27-Feb-2026: 🇺🇸 In a dramatic twist shaking the global entertainment industry, Netflix has officially withdrawn from its planned takeover of Warner Bros Discovery, clearing the path for Paramount Skydance to secure control of the storied Hollywood studio and its streaming assets. Netflix co-CEOs Ted Sarandos and Greg Peters confirmed the company would not raise its $82.7bn offer, stating that matching Paramount’s improved $31-per-share bid would no longer be “financially attractive.” 🎥📉 MediaMerger StreamingWars HollywoodDeal

Paramount sweetened its proposal by raising the offer from $30 to $31 per share, adding a $7bn regulatory termination fee and a quarterly “ticking fee” of roughly $650m in cash beginning after September. Netflix had four business days to respond — but quickly declined. Executives emphasized the acquisition was a “nice to have” at the right price, not a “must have” at any cost. Warner Bros Discovery CEO David Zaslav praised Netflix as “a great company” but signaled strong enthusiasm for the Paramount partnership, calling it a deal that would deliver “tremendous value” to shareholders. 💼📊 CorporateStrategy ShareholderValue BusinessNews

If approved by shareholders, the Ellison family’s Paramount Skydance will acquire the entirety of Warner Bros Discovery, including cable news giant CNN, reshaping the competitive landscape of film, television, and streaming. 🎞️🌍 However, the proposed merger is already drawing political heat. 🇺🇸 Senator Elizabeth Warren labeled it “an antitrust disaster,” warning of higher prices and fewer consumer choices. The deal is expected to undergo close scrutiny from the US Department of Justice amid concerns over media consolidation and competition. AntitrustDebate USPolitics EntertainmentIndustry

Netflix’s decision follows high-level meetings in Washington between Sarandos and Trump administration officials, as regulatory approval loomed large over the deal. Despite stepping back, Netflix reaffirmed its long-term strategy: focus on subscriber growth, profitability, and shareholder returns. With Paramount now the sole bidder, shareholder approval may be a formality — but the ripple effects across the global streaming wars are only just beginning. 🍿🚀 StreamingIndustry GlobalMedia DealWatch

President Donald Trump speaks at the White House on 20 February 2026 after announcing an increase in global import tariffs from 10% to 15%.

🔥 Trump Slaps 15% Global Tariff After Supreme Court Blow 🇺🇸 | Trade Shockwaves Hit 🇩🇪 🇫🇷 🇬🇧 |Trump Tariffs 15% Global Imports Supreme Court Ruling Impact

21-Feb-2026: In a dramatic escalation of his trade agenda, 🇺🇸 President Donald Trump announced Saturday that he is raising a temporary tariff on imports from 10% to 15% for goods entering the United States from all countries. The move came less than 24 hours after the U.S. Supreme Court ruled that he exceeded his authority by imposing earlier tariffs under the International Emergency Economic Powers Act (IEEPA). Reacting sharply, Trump invoked a different legal pathway — Section 122 of the Trade Act of 1974 — to immediately order a 15% worldwide levy, declaring the new rate “fully allowed” and “legally tested.” ⚖️

The rarely used Section 122 permits a president to impose tariffs of up to 15% for 150 days without congressional approval. After that period, lawmakers must authorize any extension. While Trump declared the tariffs effective immediately, it remained unclear whether formal documentation had been signed. A prior White House fact sheet indicated that earlier 10% levies would take effect at 12:01 a.m. ET on 24 February. ⏳

🌍 Global Reaction Leaders across Europe responded swiftly. 🇩🇪 German Chancellor Friedrich Merz warned that constant tariff uncertainty is “poison” for both European and American economies, pledging to travel to Washington with a unified EU position. 🇫🇷 French President Emmanuel Macron emphasized the importance of judicial checks and balances, noting that democracies rely on the rule of law and reciprocity in trade. 🇬🇧 British trade officials also expressed concern, as the UK had previously agreed to a 10% tariff arrangement with Washington.

📦 Who’s Exempt? Certain products will avoid the temporary hike, including critical minerals, metals, pharmaceuticals, and USMCA-compliant goods from 🇨🇦 Canada and 🇲🇽 Mexico. However, separate industry-specific tariffs on steel, aluminum, lumber, and automobiles remain intact under different trade laws.

💰 Economic Stakes The U.S. government has already collected at least $130 billion in tariffs under IEEPA authority, according to recent federal data. Studies indicate that approximately 90% of those costs have been borne by American businesses and consumers. Major U.S. trade associations are demanding refunds, though Trump signaled that reimbursements would likely face a prolonged legal fight.

⚡ Political Firestorm Trump sharply criticized the Supreme Court’s 6–3 decision, calling it “anti-American” and praising dissenting justices Brett Kavanaugh, Clarence Thomas, and Samuel Alito. He condemned the majority, including two of his own appointees, accusing them of lacking courage. The ruling does not affect separate tariffs imposed under other statutes, leaving portions of his broader trade policy intact.

📊 As the 15% tariff clock starts ticking, markets, manufacturers, and global trading partners brace for another round of economic uncertainty. The next 150 days could redefine not just U.S. trade policy — but global supply chains worldwide. 🌎

Trump Tariffs 2026 Global Trade War US Supreme Court Economic Policy World Markets

🇺🇸💡 ChatGPT prepares to display advertisements beside answers for US users as OpenAI introduces a new revenue model for its flagship AI platform.

🇺🇸💡 ChatGPT Enters the Ad Era: OpenAI to Show Sponsored Messages Alongside Answers

17-Jan-2026: San Francisco 🇺🇸 — ChatGPT will begin displaying advertisements to users in the United States in a major shift for the world’s most popular AI chatbot, as OpenAI looks to strengthen revenue streams beyond subscriptions. The company confirmed that ads will start rolling out in the coming weeks, marking the first large-scale advertising experiment inside ChatGPT.

ChatGPT Update AI Monetization US Rollout

OpenAI said the ads will appear only for adult users in the US during the initial testing phase. They will be placed above or below chatbot responses — not embedded within answers — and displayed in clearly tinted boxes. According to the company, ads will only be shown when there is a “relevant sponsored product or service” connected to the user’s current conversation.

Ads will not be shown to users under 18 and will be excluded from sensitive topics such as health, mental health, and politics. Users will also be able to click an option explaining why a specific ad appeared, an effort by OpenAI to maintain transparency and trust.

User Transparency No Ads for Minors

The move represents a notable change in tone from OpenAI chief executive Sam Altman, who has previously voiced discomfort with advertising. “I kind of hate ads just as an aesthetic choice,” Altman has said, emphasizing the high level of trust users place in ChatGPT and the need to ensure ads do not influence model outputs.

Despite those reservations, OpenAI faces massive financial demands. The company has committed to spending more than $1 trillion over the coming years on AI infrastructure, while Altman has said annual revenues are already running well above $13 billion. Ads, OpenAI argues, can help diversify income while keeping access to AI tools broader and more affordable.

Big Tech Spending Revenue Growth

In a blog post announcing the change, OpenAI said its enterprise and subscription businesses remain strong, but a mixed revenue model could help “make intelligence more accessible to everyone.” The company stressed that ad formats would be introduced cautiously, with user feedback playing a central role.

Alongside the ad rollout, OpenAI also unveiled ChatGPT Go, a new low-cost subscription tier priced at $8 per month, aimed at expanding its user base while offering a lighter paid option.

ChatGPT Go Affordable AI

🌍 As ChatGPT continues to evolve from a research-driven chatbot into a global consumer platform, the introduction of advertising signals a pivotal moment — balancing trust, usability, and the financial realities of powering AI at planetary scale.

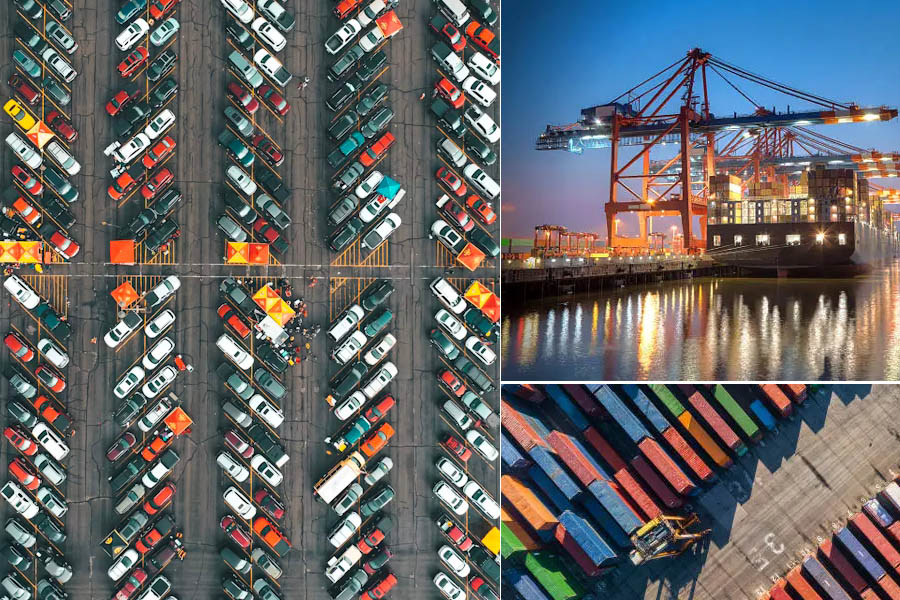

Workers clean newly built vehicles at BYD’s factory in Camaçari, Brazil, as the Chinese automaker reports 4.55 million car sales worldwide in 2025. 🇧🇷🇨🇳🚗

⚡ BYD Surges Past Tesla to Become World’s Top Electric Car Seller 🇨🇳🚗 | Global EV Power Shift

2-Jan-2026: China’s BYD has overtaken Tesla to become the world’s biggest seller of fully electric cars, marking a watershed moment in the global automotive industry. BYD sold an impressive 2.26 million battery electric vehicles in 2025, far ahead of Tesla’s 1.63 million deliveries, as Elon Musk’s company struggled with slowing demand and major policy headwinds in the United States 🇺🇸. ⚡

[■ EV MARKET LEADER ■] [■ GLOBAL AUTO SHIFT ■] [■ CHINA RISE ■]

📉 Tesla Hit by Subsidy Cuts and Political Backlash

Tesla’s sales slump followed the withdrawal of electric vehicle subsidies and emissions incentives under President Donald Trump, policies that had previously boosted demand for clean cars. The automaker also faced consumer backlash after Musk’s public embrace of far-right politics in late 2024, compounding pressure on sales. Tesla deliveries fell 9% year on year, with just 418,200 vehicles shipped in the final quarter—well below market expectations. 🧾

[■ TESLA SALES DROP ■] [■ EV SUBSIDIES CUT ■] [■ POLITICAL FALLOUT ■]

🏭 China’s Carmakers Accelerate Global Expansion

BYD’s rise reflects a broader surge by Chinese carmakers using the electric transition to challenge traditional auto giants. Exports from China have climbed sharply, led by BYD alongside rivals such as SAIC and Chery, as competitive pricing and fast innovation help them gain ground across Asia, Europe 🇪🇺, and emerging markets. 🌍

[■ CHINESE AUTO BOOM ■] [■ GLOBAL EXPORTS ■] [■ EV PRICE WAR ■]

💰 Investors Still Bet Big on Tesla’s Future Tech

Despite falling sales, Tesla remains the world’s most valuable carmaker, valued at about $1.4 trillion—more than the next 30 automakers combined. Investors continue to back Musk’s vision of Tesla as a leader in artificial intelligence and robotics, even as its share price slid 8% since Christmas Eve. 📊

[■ MARKET VALUATION ■] [■ AI & ROBOTICS ■] [■ INVESTOR CONFIDENCE ■]

🤖 Robotaxis vs “God’s Eye” as Tech Race Heats Up

Musk has long argued that autonomous driving will set Tesla apart, and the company has launched a limited robotaxi service in Austin, Texas 🇺🇸. However, Chinese competitors are close behind. BYD now offers its advanced driver-assistance system, known as “God’s Eye,” even on its cheapest models, intensifying competition in the self-driving race. 🚘

[■ AUTONOMOUS TECH ■] [■ ROBOTAXI RACE ■] [■ EV INNOVATION ■]

📈 BYD’s Broad-Based Growth Redefines the Auto Market

Founded in 1995 as a battery company by Wang Chuanfu, often dubbed China’s answer to Musk, BYD recorded total car sales of 4.55 million in 2025 when hybrids are included. While plug-in hybrid sales dipped slightly, the company more than doubled sales of electric buses and trucks to 57,000 vehicles, underlining its dominance across both consumer and commercial EV markets. 🚌⚡

[■ BYD DOMINANCE ■] [■ ELECTRIC MOBILITY ■] [■ FUTURE OF TRANSPORT ■]

Australian beef exports destined for China face a new 55% tariff as Beijing moves to protect its domestic cattle industry 🇦🇺🥩🇨🇳

🥩🇦🇺🇨🇳 Trade Shock Down Under: China Slaps 55% Tariff on Australian Beef, Sparking Industry Outrage

1-Jan-2026: Australia’s beef industry has been rocked after China imposed a steep 55% tariff on beef imports exceeding newly set quotas, a move Beijing says is designed to shield its domestic cattle sector. Producers across Australia described the decision as “extremely disappointing,” warning it could disrupt trade flows just as exports to China had begun to surge again. 【BeefTrade】 【AustraliaChina】

📦 China’s commerce ministry confirmed that from 1 January, safeguard measures will cap annual beef imports at 2.7 million metric tons for suppliers including Australia, Brazil, and the United States. Any shipments beyond that quota will face the punitive tariff for the next three years, although the quota will gradually increase each year. The cap sits below import levels recorded in the first 11 months of 2025 for Australia and top supplier Brazil. 【ImportQuota】 【ChinaPolicy】

🗣️ Beijing justified the move by claiming surging beef imports have “seriously damaged” China’s domestic cattle industry, which is only slowly emerging from oversupply. Despite this, analysts note China’s beef farming sector remains far less competitive than exporters such as Brazil and Argentina, a gap unlikely to close quickly. 【DomesticProtection】 【GlobalAgriculture】

🇦🇺 Prime Minister Anthony Albanese said Canberra is in talks with Beijing but stressed Australia was not being singled out. He downplayed the broader impact, arguing Australian beef remains highly sought after worldwide. “The Australian beef industry has never been stronger,” Albanese said, expressing confidence that global demand will continue despite the tariff shock. 【AussieExports】 【PMResponse】

🔥 Opposition figures were less restrained. Nationals leader David Littleproud branded the tariff “devastating,” while opposition leader Sussan Ley urged Albanese to leverage his relationship with President Xi Jinping to seek a carve-out for Australian producers. Within the industry, frustration boiled over as producers warned of immediate commercial fallout. 【PoliticalPressure】 【FarmersVoice】

🥩 The Australian Meat Industry Council said the tariffs were neither fair nor appropriate, arguing they undermine the long-standing, mutually beneficial trade relationship built under the China–Australia Free Trade Agreement. AMIC chief Tim Ryan said the decision appears to favor countries that have rapidly expanded exports to China, while penalizing Australia’s reliable and high-quality supply. 【TradeRelations】 【AMIC】

📉 Data shows China imported 2.59 million tons of beef in the first 11 months of this year, down slightly from 2024. Analysts expect imports to fall further in 2026 as the new quotas bite. Brazil alone shipped 1.33 million tons during the same period, already well above the newly announced quota levels. 🇧🇷📊 【MarketData】 【BeefImports】

🌏 Australia’s beef shipments to China had surged in 2025, partly gaining market share from the United States after Beijing allowed permits at hundreds of US meat plants to lapse amid renewed tariff tensions under Donald Trump. Industry leaders say exporters will now pivot to other markets if access to China tightens. “There’s plenty of other countries that will take our product,” said Western Beef Association chair Mark Thomas. 🌍🚢 【GlobalMarkets】 【ExportShift】

🧭 As the tariff takes effect, the episode highlights growing trade friction and China’s willingness to use protective measures even against trusted suppliers. For Australia’s beef producers, the challenge now is navigating a reshaped global market while defending access to one of the world’s most valuable consumers. 【TradeTensions】 【BusinessNews】

Traders work on the floor of the New York Stock Exchange on New Year’s Eve as Wall Street closed 2025 near record highs 🇺🇸📈

📈🇺🇸 Wall Street Defies Chaos: US Markets End 2025 Near Record Highs as Tech & AI Power a Relentless Rally 🤖💹

31-Dec-2025: ✨ Wall Street closed out 2025 just shy of record highs, capping a turbulent year marked by economic shocks, political uncertainty, and bold policy swings. Despite inflation pressures, stalled job growth, and geopolitical tension, US stock markets surged ahead — fueled by soaring technology valuations and growing hopes that interest rates will ease in 2026. 【MarketMomentum】 【WallStreet2025】

📊 The benchmark S&P 500 climbed an impressive 16.4% over the year, finishing at 6,845.50 on New Year’s Eve in New York, even as it dipped 0.7% in the final trading session. Investors largely brushed aside fears surrounding global instability, riding an ongoing frenzy around artificial intelligence and big tech dominance. 🇺🇸🚀 【SP500】 【AIWave】

🌍 Global markets outpaced even Wall Street’s strong showing. In the UK, the FTSE 100 surged 21.5% — its biggest annual gain since 2009 — reflecting renewed confidence among investors in London. Meanwhile, the Dow Jones Industrial Average gained 13.4% in 2025, and the tech-heavy Nasdaq Composite rocketed 20.5%, underlining tech’s commanding grip on global finance. 🇬🇧🇺🇸 【GlobalMarkets】 【FTSE100】

Investor nerves were rattled in the spring by President Donald Trump’s aggressive push for sweeping tariffs on global imports. Initial panic later morphed into cynical calm around the so-called “TACO trade” — Trump Always Chickens Out. While some tariffs were rolled back amid pressure from businesses and consumers, overall US tariff levels still climbed to their highest effective rate since 1935. 🇺🇸📦 【TradeWars】 【TariffShock】

🏛️ Adding to uncertainty, the longest US government shutdown in history clouded the economic outlook, as inflation remained stubborn and hiring momentum slowed. The Federal Reserve’s looming interest-rate decisions kept markets guessing — yet stocks continued to rise, defying traditional warning signs. 【FedWatch】 【EconomicFog】

🤖 The engine of the rally was unmistakably tech. The Nasdaq has surged more than 110% since OpenAI unveiled ChatGPT in late 2022, igniting global fascination with artificial intelligence. At the center stands Nvidia, which became the first public company ever to reach a $4 trillion market value this summer. Its stock ended 2025 up 34.8%, with a staggering valuation of $4.55 trillion. 💎🖥️ 【Nvidia】 【AIBoom】

📱 Tech giants including Apple, Microsoft, Amazon, Alphabet (Google & YouTube), and Nvidia now dominate the S&P 500, helping the index secure its third straight positive year — though growth was weaker than in the previous two. Analysts largely expect this trend to continue into 2026, with optimistic forecasts pointing toward another year of gains. 📈🔮 【BigTech】 【MarketOutlook】

🏦 A rising market is politically convenient for President Trump, who frequently cites stock rallies as proof of economic strength. Despite occasional public skepticism, he is widely seen as closely tracking Wall Street’s performance as a measure of success. 🇺🇸📊 【PoliticsAndMarkets】 【TrumpEconomy】

😟 Yet beneath the market highs lies public unease. A Harris poll shows twice as many Americans believe their financial security is worsening rather than improving. Economists warn the rally has disproportionately benefited the wealthy, reinforcing what many describe as a “K-shaped economy” — where investors thrive while households without stock portfolios struggle to keep up. ⚖️💔 【Inequality】 【KShapedEconomy】

🧭 As 2026 approaches, Wall Street’s message is clear: markets are booming — but the gap between financial markets and everyday life remains wider than ever. 🌐💰 【USMarkets】 【EconomicDivide】

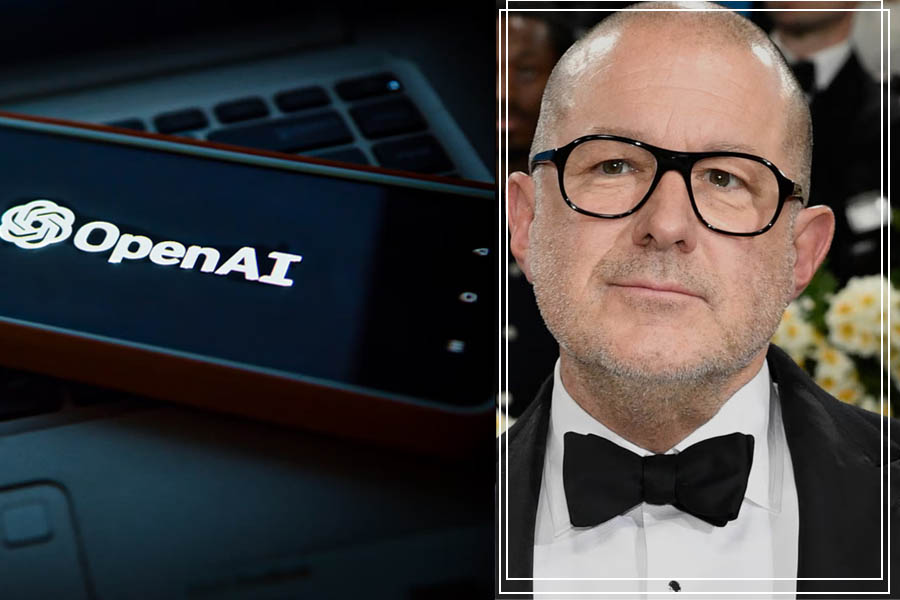

Sam Altman warns the new OpenAI preparedness chief will “jump into the deep end” from day one 🤖

🤖🔥 OpenAI Offers $555K Salary for AI’s Most Stressful Job as Fears Grow Over Runaway Technology

29-Dec-2025: OpenAI 🇺🇸, the creator of ChatGPT, has posted a jaw-dropping $555,000-a-year vacancy for what may be one of the most daunting roles in the artificial intelligence world: Head of Preparedness. The position comes with immense responsibility — and pressure — as concerns mount that increasingly powerful AI systems could pose serious risks to humanity.

Sam Altman, OpenAI’s chief executive, described the role bluntly: “This will be a stressful job, and you’ll jump into the deep end pretty much immediately.” The successful candidate will be tasked with defending against AI-related threats to mental health, cybersecurity, and even biological weapons, while preparing for a future where advanced AI systems may begin training themselves. 🧪💻

🟥 [AI Safety Alert] 🟥 [Future of Humanity] 🟥 [Cybersecurity Risks] 🟥 [Tech Industry Warning]

The new head of preparedness will be responsible for identifying, evaluating, and mitigating emerging threats from so-called “frontier AI capabilities” — systems powerful enough to cause severe harm if misused. The role has already proven difficult to sustain, with previous executives reportedly lasting only short periods amid the intensity of the work.

Alarm bells are ringing across the tech world. Mustafa Suleyman, CEO of Microsoft AI 🇺🇸, warned that anyone not feeling uneasy “is not paying attention,” while Demis Hassabis of Google DeepMind 🇬🇧 cautioned that AI could go “off the rails” and harm humanity if left unchecked. Despite these warnings, global regulation remains minimal, leaving companies largely to police themselves.

🟦 [Unregulated AI] 🟦 [Frontier Technology] 🟦 [Digital Threats] 🟦 [Global Tech Race]

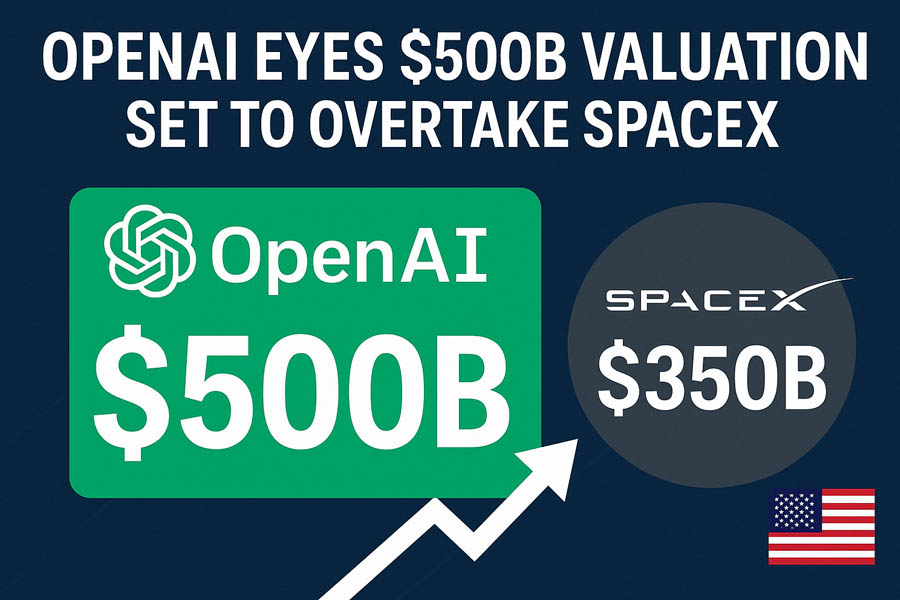

Altman acknowledged the unprecedented nature of the challenge, saying the world needs “more nuanced understanding” of how AI capabilities could be abused — and how to limit those dangers without losing the technology’s enormous benefits. Alongside the salary, the role includes an unspecified equity stake in OpenAI, a company now valued at around $500 billion. 💰📈

The urgency is underscored by real-world incidents. Rival firm Anthropic recently reported AI-enabled cyberattacks operating with near autonomy, while OpenAI admitted its latest model is nearly three times better at hacking than versions released just months ago. 🕵️♂️⚔️

OpenAI is also facing lawsuits tied to alleged psychological harm linked to ChatGPT interactions. The company says it is improving safeguards to detect emotional distress and guide users toward real-world help — but the cases highlight the growing stakes as AI becomes more embedded in daily life.

As artificial intelligence races ahead faster than the rules designed to govern it, OpenAI’s $555K job posting reads less like a vacancy — and more like a warning sign for the future of humanity itself. 🌍⚡

Elon Musk becomes the world’s first $600 billion individual as SpaceX moves closer to a historic IPO.

🚀💰 Elon Musk Breaks All Records: World’s First $600 Billion Man as SpaceX IPO Nears 🇺🇸🌍

15-Dec-2025: 🚨 History was made on Monday when Elon Musk officially became the first individual ever to reach an estimated net worth of $600 billion, according to Forbes. The milestone comes as SpaceX moves closer to a blockbuster initial public offering, reportedly targeting a jaw-dropping valuation of $800 billion. 🌌📈 Wealth Shock Global Markets

🛰️ Musk owns roughly 42% of SpaceX, and the planned IPO could catapult his personal fortune by an estimated $168 billion, pushing his total wealth to around $677 billion as of Monday afternoon (ET). No billionaire in modern history has ever crossed the $500 billion threshold before Musk, making this a once-in-a-generation financial moment. 🇺🇸💎 Space Economy IPO Fever

⚡ The surge in Musk’s wealth is also powered by his nearly 12% stake in Tesla. Despite slowing electric-vehicle sales, Tesla shares are up 13% this year and jumped nearly 4% on Monday after Musk revealed that the company is testing robotaxis without safety monitors in the front passenger seat. 🤖🚗 Future Mobility EV Revolution

📊 In November, Tesla shareholders approved a record-shattering $1 trillion pay package for Musk — the largest corporate compensation plan ever — signaling strong investor confidence in his vision to transform Tesla into an AI and robotics powerhouse. The vote cemented Musk’s grip on the future of advanced automation. 🧠⚙️ AI Power Investor Confidence

🤖 Meanwhile, Musk’s artificial-intelligence venture xAI is reportedly in advanced talks to raise $15 billion in new funding at a valuation of around $230 billion, underscoring the scale of capital flowing into AI as the next global battleground. From space to cars to intelligence itself, Musk’s empire is expanding on every front. 🌐🔥 AI Race Tech Titans

📢 Musk, along with Tesla, SpaceX, and xAI, did not immediately respond to requests for comment. Still, the numbers alone tell a powerful story: the age of trillion-dollar visions is no longer theoretical — it’s happening now. 💥📡 Breaking News Global Impact

The Paramount Pictures logo displayed at Paramount Studios in Los Angeles, California.

💥 Paramount Drops a $108.4B Bombshell: Hostile Takeover Bid Challenges Netflix’s WBD Deal 🎬🇺🇸

8-Dec-2025: Hollywood’s power struggle has erupted into an all-out bidding war as Paramount Skydance, led by David Ellison, launched a stunning $108.4bn hostile takeover bid for Warner Bros Discovery (WBD). Business MediaWar HollywoodShakeup

The move comes just days after Netflix announced its own massive $82.7bn offer to acquire WBD’s iconic film studio and HBO streaming empire — but not its traditional TV branches like CNN or the Discovery Channel. Paramount’s shocking counteroffer goes further: an all-cash bid for the entire company, promising shareholders a richer valuation and a smoother regulatory path. 🎥💰

WBD confirmed it will “carefully review” the offer and deliver guidance to shareholders within two weeks. Paramount argues its deal is superior in every way and would avoid the regulatory challenges facing Netflix’s mixed cash-and-stock proposal. 🇺🇸 USA Corporate Clash Intensifies

The Ellison family — David and Oracle titan Larry Ellison — enjoy close ties to Donald Trump, who has publicly backed a Paramount takeover. The bid is bolstered by heavyweight investors, including Jared Kushner’s Affinity Partners, the Saudi Public Investment Fund, and the Qatar Investment Authority. 💼🌍 A global network of political and financial influence now surrounds the deal.

Paramount’s statement blasted the Netflix arrangement as “an inferior proposal”, exposing WBD shareholders to market uncertainty and future complications in its cable network business. “Our proposal is superior in every dimension,” declared David Ellison, who insisted shareholders deserve a chance to accept the more lucrative all-cash payment. WBD Paramount

Netflix appears unfazed. Co-CEO Ted Sarandos called the move “totally expected” and expressed complete confidence in pushing its deal to completion. But industry insiders say Paramount’s aggressive strike could reshape everything, reigniting fears among employees at CNN and CBS News as speculation about mergers and job cuts grows.

CNN staff voiced relief that Netflix’s original deal would spin the network into an independent company — avoiding a merger with CBS News, now run by Bari Weiss. But Paramount’s hostile move threatens to rekindle anxiety. CBS employees have also expressed deep concern that a merged mega-network could trigger widespread layoffs. 📺

Regulatory hurdles loom large. Although the FCC is not expected to intervene, the Department of Justice will review antitrust issues. Paramount, however, insists its takeover is pro-consumer, competition-friendly, and capable of securing “expeditious regulatory approval.”

The Ellisons’ bid expires on January 8, setting the clock ticking on one of the most dramatic corporate showdowns in entertainment history. “We’re here to fight for value,” Ellison said. “This transaction is about building more, not cutting back.” 🎬🔥 The Hollywood takeover war is officially on.

GlobalMedia StreamingWars CorporateShowdown

Kevin Zhu, founder of Algoverse, leads an AI research and mentoring program designed for high school students.

🔥 AI Research in Turmoil: The Shocking Truth Behind 100+ Papers by One Author 🌐🤖

🇺🇸 【US】 AIResearch 6-Dec-2025: Artificial intelligence research is facing what experts call a “slop crisis,” as an astonishing revelation shakes the global academic community. A young researcher, Kevin Zhu — who recently completed his computer science degree at UC Berkeley — claims to have authored an unprecedented 113 AI papers in a single year. Of these, 89 are set to be presented this week at NeurIPS, one of the world’s most prestigious AI conferences. 😮🔥

But leading academics warn that this flood of papers signals a deeper collapse in quality. Berkeley professor Hany Farid called Zhu’s output a “disaster,” accusing the work of being little more than “vibe coding” — software or research generated rapidly with the help of AI tools rather than rigorous scientific method. 🧪💥 AcademicCrisis

🇺🇸 Zhu runs Algoverse, an AI mentoring program that charges students over $3,000 for guidance and conference submissions. Many of his co-authors are high school students, raising questions about authorship ethics and research oversight. He maintains that all papers are “team efforts,” and only “standard productivity tools” — including AI for editing — were used. AIWorkshops

🌍 AI researchers say the real problem is bigger: an industry drowning in low-quality submissions. Conferences like NeurIPS have exploded from under 10,000 submissions in 2020 to more than 21,500 this year. ICLR, another major AI conference, saw a 70% surge in submissions for 2026. Reviewers are overwhelmed, and many suspect that AI-written papers are slipping through the cracks. PeerReviewPressure

🇨🇳 Chinese tech analysis platform 36Kr reported that reviewer scores across major conferences have sharply dropped, calling the situation a “taste crisis” for AI science. Even NeurIPS organizers admit their system is under strain, forced to rely heavily on overworked PhD students for reviews. ResearchOverload

Experts warn this “slop flood” could undermine the entire field. With big tech companies and AI safety groups now posting massive volumes of unreviewed work to arXiv, the line between credible science and noise is blurring. Professor Farid says even he struggles to understand what’s truly happening inside the fast-moving world of AI research. 📉 “Your signal-to-noise ratio is basically one,” he warns. SignalVsNoise

🇰🇷 In May 2025, three South Korean computer scientists won a major award for proposing solutions to this crisis — showcasing how severe the problem has become. But despite efforts to restore quality, many fear the future of AI research is heading toward chaos. FutureOfAI

Farid now advises students to avoid entering AI research altogether. 💬 “You can’t keep up, you can’t publish good work, you can’t be thoughtful. It’s just a mess,” he says. The AI revolution may be accelerating — but the scientific foundation beneath it is showing cracks that can no longer be ignored. 🌐🔥 AIIntegrity

A scene from *The White Lotus* Season 3. If the deal proceeds, Netflix would become the new owner of HBO, the creator of the acclaimed series.

🚨 Netflix Surges Ahead in Bid to Acquire Warner Bros Discovery — A Streaming Shake-Up That Could Rewrite Hollywood 🌎🎬

■ TrendingNow ■ BreakingDeal ■ HollywoodShift

5-Dec-2025: In a stunning industry twist, Netflix 🇺🇸 has entered *exclusive negotiations* to buy the streaming and studio empire of Warner Bros Discovery 🇺🇸 — a mega-move poised to reshape global film and television as we know it. The deal would give Netflix control of world-renowned brands, including Warner Bros Studios, HBO, and HBO Max, elevating the streaming giant into a new Hollywood superpower.

💰 According to Bloomberg, Netflix has put forward an aggressive $70–$75 billion offer (valued at $28–$30 per share), far exceeding Warner Bros Discovery’s current market value of about $60 billion. To sweeten the bid — and demonstrate confidence — Netflix is reportedly offering a massive $5 billion breakup fee if the deal is blocked by U.S. regulators.

■ USMediaWar ■ DealOfTheDecade

🏁 Netflix is racing against heavyweights Paramount Skydance 🇺🇸 and Comcast 🇺🇸 (owner of Universal Studios and Sky 🇬🇧🇮🇹🇩🇪) — both of which have also dangled $5 billion termination guarantees. Paramount, backed by billionaire Larry Ellison, has argued that its proposal is more likely to pass regulators and has accused Warner Bros of running a “tainted” auction favoring Netflix.

🎥 A successful acquisition would hand Netflix the crown jewels of American entertainment — including *Game of Thrones*, *Succession*, *The Sopranos*, *The White Lotus*, *Harry Potter*, and *Batman*. The move would also grant Netflix access to one of the world’s deepest TV archives, from *Friends* to *Looney Tunes*.

🌐 But analysts warn of serious antitrust concerns: combining two of America’s biggest streaming services could trigger one of the toughest regulatory reviews in entertainment history. Netflix insists that Warner Bros films would continue enjoying wide theatrical releases — a promise aimed at calming industry fears.

■ GlobalCinema ■ StreamingGiants

📡 Before any deal closes, Warner Bros Discovery plans to spin off its cable TV channels — including CNN 📰, TBS 📺, and TNT 🎯 — separating legacy media from the streaming and studio-based future.

🎬 This week, legendary filmmaker James Cameron 🇨🇦 sounded an alarm, warning that selling Warner Bros to Netflix could cause a “catastrophic loss of long-term value” for Hollywood. Still, Warner Bros has remained silent, offering no public comment as negotiations intensify.

🏷️ Warner Bros Discovery officially entered the market in October, attracting widespread interest — but Netflix now stands at the front of the line in what could become Hollywood’s most consequential sale in decades.

Rachel Reeves, the chancellor, displays the iconic red budget briefcase to the media outside Downing Street.

🇬🇧💥 Rachel Reeves Unveils £26bn Tax Shock: UK’s Wealthiest Hit Hard in Historic Budget 🔥

26-Nov-2025: In a landmark move that could redefine Britain’s fiscal direction, Chancellor Rachel Reeves has unveiled a **£26bn tax-raising budget** aimed squarely at the nation’s wealthiest households. The sweeping package—which includes scrapping the two-child benefit cap and cutting energy bills—marks one of the boldest shifts toward economic redistribution in recent UK history. PowerShift Budget2025

Reeves emphasized she was “**asking everyone to contribute**” to repairing public finances but made it clear that those with the **broadest shoulders** should bear the heaviest load. The budget—released amid a chaotic leak by the Office for Budget Responsibility (OBR)—will push the nation’s tax burden to an unprecedented **38% of GDP within five years**, signalling a dramatic new chapter for the 🇬🇧 UK economy.

🏠💸 Mansion Tax, Threshold Freezes & Rising Burdens: Middle Britain Feels the Pinch

While the wealthy face new levies—including a **council tax surcharge for properties above £2m**—more than **1.7 million workers** will also be drawn into higher tax bands due to a three-year freeze on income tax and national insurance thresholds. This “**fiscal drag**” means nearly **one in four taxpayers** will soon pay higher-rate tax, affecting nurses, teachers, police officers, and thousands of middle-income families. MiddleSqueeze

The OBR warns that living standards will rise by a mere **0.25% a year**, far lower than expected earlier this year. With real household disposable income barely moving, the budget’s true cost may be felt most acutely by working families struggling to keep pace with inflation.

⚡🏡 Energy Bills Slashed, Cost of Living Relief Kicks In

In one of the most welcome announcements, Reeves confirmed the removal of green levies from energy bills—now funded through general taxation—cutting the average household bill by **£150 a year** starting April. Rail fares will be frozen, and key cost-of-living support strengthened, marking a major attempt to help families cope amid continued economic uncertainty. CostRelief

🏛️🔥 Labour Rises Leftward as Reeves Galvanizes Party — But Critics Warn of Economic Risks

Labour MPs cheered the chancellor’s decision to fully **scrap the two-child benefit cap**, a £3bn policy expected to lift **450,000 children out of poverty**. The move was hailed as a “full-blooded Labour” shift, cementing support from the party’s left flank and buying time for Keir Starmer amid rumours of leadership unrest. LabourShift

But critics—including several cabinet ministers and the Conservative leader Kemi Badenoch—denounced it as a “**Benefits Street budget**,” arguing it punishes ordinary workers while favouring ideological priorities. Analysts also flagged that most tax rises are **backloaded until 2028**, prompting concerns that the plan may rely too heavily on optimistic long-term forecasts.

📉📈 Markets React Calmly as Gilts Fall and Fiscal Headroom Expands

Financial markets breathed a sigh of relief as Reeves more than doubled the UK’s fiscal buffer to **£21.7bn**, stabilizing gilt yields and calming investor fears. Bonds rallied even before the chancellor began speaking, thanks to the OBR’s prematurely posted budget report. MarketWatch

Economists caution, however, that Reeves’ plan to “**spend now, tax later**” is a high-stakes gamble. Borrowing will rise over the next three years, with steep adjustments expected near the end of the parliamentary term—a period that may bring unpredictable political and economic turbulence.

🗳️🔥 Political Battle Lines Emerge Ahead of 2025 as Reeves Calls for ‘Daily Campaigning’

Addressing MPs late Wednesday, Reeves urged Labour to **“win the argument every single day”** as she braced them for fierce political and media backlash. Meanwhile, senior leftwing MPs insisted the budget must be “only the beginning”—a precursor to broader reforms ensuring fairness, simplicity, and equitable taxation. ReformNow

As the UK steps into a defining fiscal era, Reeves’ budget has ignited both **hope and controversy**, raising profound questions about the country’s financial future—and the political battles that lie ahead.

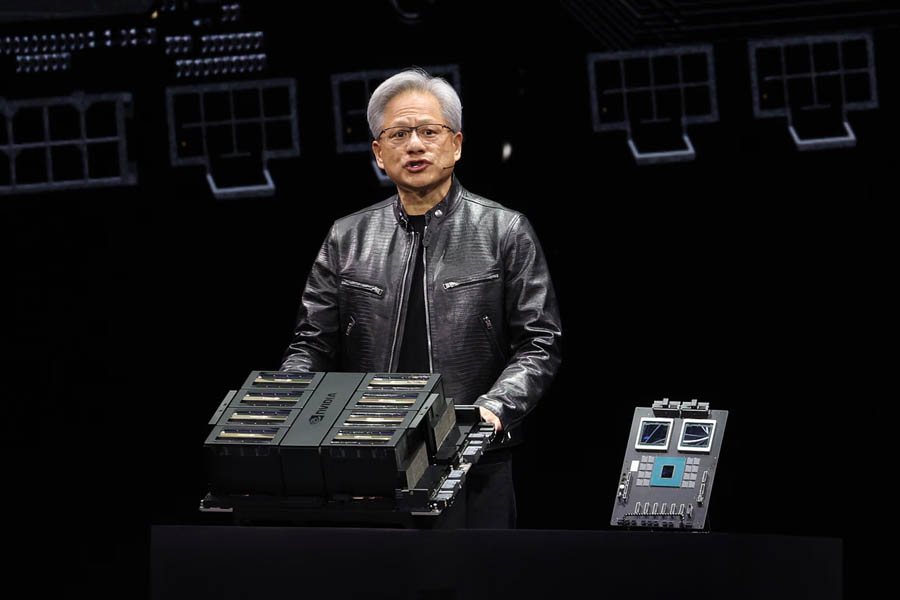

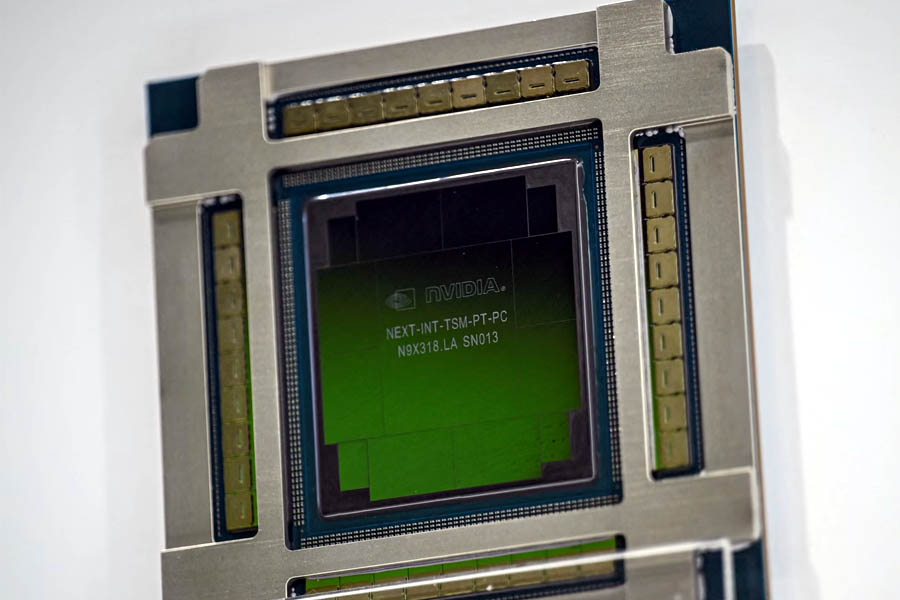

Jensen Huang, the Nvidia chief executive, attends the US-Saudi Investment Forum in Washington on Wednesday, addressing global AI growth and market concerns.

🚀 Nvidia Shatters Wall Street Fears as Jensen Huang Declares “We Excel at Every Phase of AI” 🌐💹

🟦 **GLOBAL MARKETS REBOUND** | 19-Nov-2025: World markets surged after **Nvidia 🇺🇸**, the world’s most valuable company and AI powerhouse, delivered **record-smashing Q3 earnings** that exceeded Wall Street expectations. The results offered temporary relief to investors fearing an AI bubble amid heavy stock selloffs earlier this month.

🟩 **HUANG FIRES BACK AT BUBBLE FEARS** | CEO **Jensen Huang**, opening the earnings call with a bold message, pushed back against speculation: “From our vantage point, we see something very different… **We excel at every phase of AI—from pre-training to post-training to inference.**” What he described instead was a monumental shift shaping the future of global tech infrastructure.

📈 Nvidia’s Revenue Skyrockets as AI Boom Accelerates ⚡🧠

🟧 **RECORD-BREAKING NUMBERS** | Nvidia posted **$57.01bn in revenue**, crushing expectations of $54.9bn. Diluted EPS landed at **$1.30**, beating analyst forecasts of $1.26. The company’s data-center sales alone hit **$51.2bn**, a jump that stunned the industry. With **62% year-over-year growth** and a **Q4 revenue target near $65bn**, Nvidia shows no signs of slowing.

🟥 **THREE MAJOR TECH SHIFTS** | Huang highlighted a trio of transformations reshaping technology: — The shift from general computing to **accelerated computing** — The rise of **generative AI** — The emergence of **agentic and physical AI**, such as robotics and autonomous vehicles “Nvidia enables all three transitions,” he said, emphasizing the company’s unmatched position in the AI ecosystem.

🟦 **“AI IS GOING EVERYWHERE, DOING EVERYTHING, ALL AT ONCE.”** Demand for Nvidia chips continues to soar globally, reinforcing its dominance as the beating heart of the AI revolution.

📊 Analysts: “Nowhere Near the Peak of the AI Revolution” 🌍🔥

🟪 **MARKET CONFIDENCE RETURNS** | Analysts praised the earnings as confirmation that AI demand remains explosive. Investing.com’s Thomas Monteiro called the results **“a clear answer: AI is nowhere near its peak.”** Nvidia’s chips, he said, have become the central infrastructure of the modern tech economy.

🟫 **STILL, INVESTOR NERVES REMAIN** | Nvidia’s stock dipped 7.9% in November after major investors like Peter Thiel’s hedge fund and SoftBank sold billions in shares, stoking bubble worries. Yet after the earnings release, Nvidia’s stock rebounded **over 5%**, boosting S&P 500 and Nasdaq futures and lifting Asian markets.

Experts Warn of Long-Term Risks Despite Nvidia’s Triumph 🧩📉

🟨 **BALANCING ON A TIGHTROPE** | Analysts say Nvidia’s surge calmed immediate AI-bubble panic, but long-term concerns persist. “This is a market balancing on a wire stretched between AI euphoria and debt-filled reality,” warned Stephen Innes of SPI Asset Management.

🟤 **IS THE GROWTH SUSTAINABLE?** | Forrester analyst Alvin Nguyen cautioned that Nvidia’s growth may not hold forever. “AI demand is unprecedented, but if supply catches up or innovation slows, Nvidia’s share growth will cool.”

🟩 **THE AI FUTURE STILL BELONGS TO NVIDIA** | Despite investor jitters, experts agree: Nvidia remains the **undisputed leader** in AI computing, with no serious rival in sight. As the world transforms faster than ever, Nvidia’s chips continue to power everything from ChatGPT to self-driving cars—fueling the next era of global tech.

Nexperia vital “legacy chips” used in cars and electronics across Europe and Asia. ⚙️🌍

⚙️ Semiconductor Showdown: Dutch Takeover of Chinese Chip Maker Sends Shockwaves Through Global Car Industry 🌍

11-Nov-2025: 🚗 In a dramatic turn of events, the Netherlands 🇳🇱 has invoked a **Cold War-era emergency law** to seize control of Nexperia — a Chinese-owned chip manufacturer vital to the global automobile supply chain. The move has ignited a fierce geopolitical battle with China 🇨🇳, shaking the already fragile car industry battered by U.S. tariffs and China's export curbs. GlobalTradeCrisis ChipWar2025

🇳🇱 Dutch Takeover Sparks Beijing Fury 🔥

The Dutch Minister of Economic Affairs declared that "serious governance shortcomings and actions within Nexperia" threatened the nation’s economic security. In response, China accused the Netherlands of **political interference**, imposing export controls and halting chip deliveries to Europe. The Dutch countered by freezing supplies needed for production in China — a tit-for-tat escalation that rattled automakers worldwide. EconomicTensions ChinaVsEU

💥 The Chip at the Heart of the Crisis

At stake is a crucial part of the world’s semiconductor ecosystem — **“legacy” chips** used in everything from airbags and power steering to central locking systems. Nexperia supplies hundreds of millions of these components to global carmakers. Roughly **80% of its production** is sent to China for processing, highlighting just how dependent automakers have become on Beijing-controlled supply chains. Experts warn this exposes the West’s weakness in critical technology infrastructure. SupplyChainCrisis AutoIndustryShock

🇺🇸🧩 Global Rivalry Deepens

This isn’t just an industrial dispute — it’s another flashpoint in the **U.S.–China tech rivalry**. The U.S. placed Nexperia’s parent company, Wingtech Technology, on its 2024 watch list, citing national security concerns. Dutch court papers revealed U.S. authorities had warned The Hague about Nexperia’s Chinese leadership before the takeover. The Dutch deny acting under American pressure, yet evidence suggests fears that critical resources and intellectual property were being shifted to China. TechColdWar SecurityRisk

🚘 Carmakers on Edge as Supply Chains Snap

Automakers are scrambling. European suppliers warn of delays and rising costs, while chip shortages loom again. Experts say switching suppliers like Infineon or NXP is technically possible but **“extremely complicated and costly”**, as each chip is tailored for specific vehicle systems. “This is what decoupling looks like at the corporate level — a huge mess,” says analyst Tom Nunlist. CarCrisis TechDependency

🌐 Fragile Truce Amid U.S.–China Trade Chill

Even as U.S. President Donald Trump 🇺🇸 and China’s Xi Jinping 🇨🇳 agreed to a one-year trade truce suspending some export bans, the Nexperia saga threatens to unravel this fragile peace. Europe finds itself caught in the middle, struggling to maintain semiconductor flows without angering either power. EU Trade Commissioner Maros Sefcovic urged for a “lasting, stable framework” with China, but Brussels remains frustrated by the Dutch unilateral move. TradeTruce EUChinaTalks

A Lesson in Digital Sovereignty and Economic Fragility

The crisis over Nexperia underscores a harsh truth — **digital sovereignty and economic security are now intertwined**. As Western nations seek to decouple from Chinese tech, the road ahead promises more turbulence for industries relying on global chip networks. The incident leaves the EU, China, and the U.S. grappling with the same question: Who truly controls the technology that drives the modern world? FutureOfTech ChipCrisis2025

A potential IPO would help OpenAI CEO Sam Altman fund massive investments in AI infrastructure, including building cutting-edge data centres worldwide.

🚀 OpenAI Eyes $1tn Stock Market Debut with Potential IPO 💰🤖

30-Oct-2025: 🟩 OpenAI, the creator of the viral AI chatbot ChatGPT, is reportedly preparing for a stock market listing that could value the company at a staggering $1tn (£760bn). The company may file for an IPO as soon as the second half of 2026, aiming to raise at least $60bn to fund massive expansions in AI infrastructure and datacentres. 📈🌐

💡 Sam Altman Signals IPO as Likely Path Forward 🧠💸

🟧 CEO Sam Altman acknowledged during a staff livestream that an IPO “is the most likely path” given the company’s capital needs. While OpenAI emphasizes that building a durable AI business is the priority, a public listing would accelerate its ambitions in artificial general intelligence (AGI) — systems capable of outperforming humans at most economically valuable tasks. 🤖⚡

🏛️ From Nonprofit Roots to For-Profit Giant 🔄

🟦 Founded in 2015 as a nonprofit, OpenAI recently restructured its main business into a for-profit entity while remaining controlled by the nonprofit parent. The move also solidified Microsoft’s 27% stake in the company, valuing OpenAI at $500bn under the deal, and boosting Microsoft’s market cap past $4tn. 💼💻

📊 Financial Snapshot: Revenue & Losses 💹

🟨 OpenAI reportedly generated $4.3bn in revenue during the first half of 2025 but posted an operating loss of $7.8bn. Despite the loss, investor confidence remains high as AI continues to drive technology valuations, although experts warn that the sector may be entering a speculative bubble. 💰

🌍 AI Market Bubble Concerns & Global Impact 🌐

🟪 Officials from the Bank of England recently flagged the risk of overinflated AI stock prices, warning that equity markets could be exposed if expectations around AI’s economic impact soften. Analysts will be closely monitoring OpenAI’s IPO and its effects on global tech markets. 📉🌏

📅 Timeline & IPO Outlook 🗓️

🟩 Sources suggest OpenAI is targeting a 2027 listing, though some advisers hint the IPO could happen in 2026. The float could become one of the largest in history, setting a new benchmark for AI companies seeking capital to expand rapidly. Investors and tech enthusiasts are keeping a keen eye on developments. 👀🚀

Shell reports record profits of $43bn as production surges in Brazil and the Gulf of Mexico, despite global oil price fluctuations and environmental protests.

💰 Shell Posts $43bn Profits as Brazil & Gulf of Mexico Production Hits Records 🌎🛢️

30-Oct-2025: 🟩 Global oil giant Shell has surpassed $43bn in profits for the year, buoyed by record-breaking fossil fuel production in Brazil and the Gulf of Mexico. The company reported $5.4bn earnings for Q3, a 27% increase over the previous quarter, despite lower oil and gas prices globally. 📈🌍

🛢️ Whale Platform & Deepwater Assets Drive Growth 🐋⚡

🟧 Shell’s CEO, Wael Sawan, highlighted the success of the Whale platform and other deepwater projects in the Gulf of America and Brazil, which exceeded production expectations in half the expected time. Over half of Shell’s oil and gas volumes now come from these regions, reinforcing its position as a top player in the energy sector. 🏗️🌊

🇬🇧 UK Windfall Tax & Fiscal Environment 🔍💷

🟦 In the UK, Shell faced a $509m windfall tax for the first nine months of the year, introduced after Russia’s invasion of Ukraine. However, Finance Minister Rachel Reeves is reportedly considering scrapping the tax earlier than planned to boost North Sea investments and jobs. Shell emphasizes the importance of a “predictable and progressive tax system” for sustained growth. ⚖️💡

📉 Oil Prices & Share Buybacks 🔄💵

🟨 Despite oil prices dropping to $65-$69 per barrel, Shell continues its ambitious shareholder strategy. The company has announced $3.5bn in buybacks for the next three months — marking the 16th consecutive quarter of returning cash to investors. Over the past four years, Shell has repurchased nearly a quarter of its shares. 🔁📊

✊ Protests Target London HQ Over ‘Horror Show’ Profits 🎃🔥

🟪 Environmental activists from Fossil Free London staged a protest at Shell’s London headquarters, criticizing the company’s enormous earnings and the social and environmental consequences of fossil fuel extraction. Robin Wells called the profits a “horror show,” highlighting global exploitation and climate impact. 🌍🚨

💡 Key Takeaways & Energy Insights ⚡🛢️

🟩 Shell’s record profits reflect booming production in key regions despite lower global oil prices. Investors should watch share buyback trends, fiscal changes in the UK, and ongoing environmental protests. While Shell remains financially robust, rising climate activism and regulatory shifts could influence the energy sector in the near term. 🌐📈

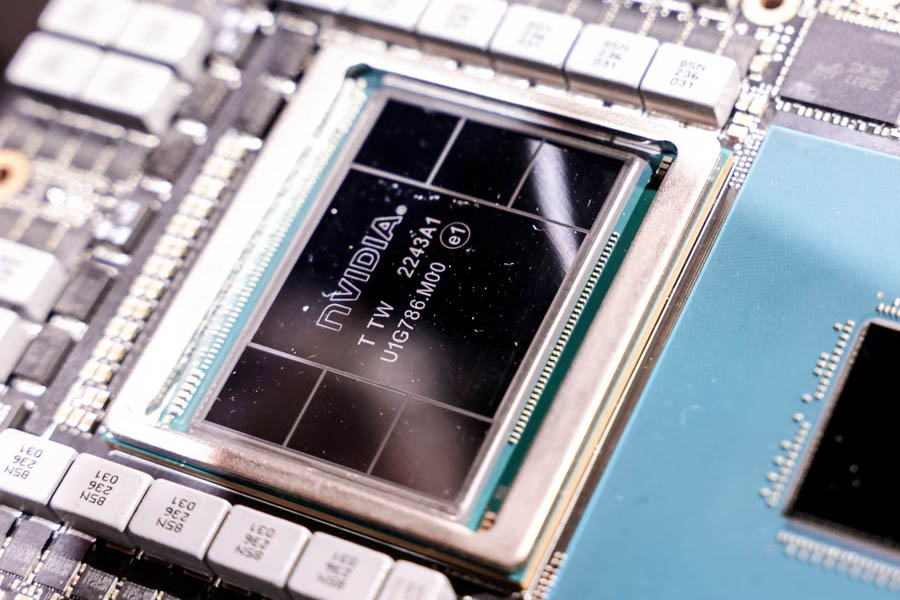

Nvidia becomes the world’s first $5 trillion company as AI demand and U.S. stock markets soar, marking a historic milestone for the Silicon Valley chipmaker.

🚀🌎 Nvidia Becomes World’s First $5 Trillion Company Amid AI & Market Boom

30-Oct-2025: 🇺🇸 Nvidia has made history as the world’s first company to hit a $5 trillion valuation, powered by an unstoppable surge in artificial intelligence and a record-breaking US stock market. 🌐 Just three months after breaking the $4 trillion barrier, the Silicon Valley chipmaker soared past a new milestone as shares climbed to $207.86, pushing its total market cap to $5.05 trillion. ◎NvidiaRise ◎AIRevolution

💡 Nvidia’s Value Now Bigger Than the Economies of India, Japan & the UK

According to the International Monetary Fund (IMF), Nvidia’s market value now surpasses the GDP of India, Japan, and the United Kingdom — a staggering reflection of the company’s global dominance. 💰 The semiconductor titan has rapidly outgrown all its chip industry competitors, riding the wave of an AI investment frenzy that has lifted tech stocks across Wall Street. ◎GlobalTechPower ◎EconomicGiant

⚙️ Massive Demand for AI Chips Fuels Nvidia’s Meteoric Rise

🔥 The company’s astonishing growth stems from a ravenous global appetite for its AI chips, which power everything from chatbots to supercomputers. Nvidia’s technology lies at the heart of the modern AI ecosystem, driving tools used by OpenAI, Google, Meta, and Microsoft. The momentum has been so intense that CEO Jensen Huang recently revealed $500 billion in chip orders — a figure that sent Wall Street into a frenzy. 📈 ◎ChipDominance ◎TechMomentum

🤝 Big Partnerships: Uber, Nokia & U.S. Energy Department Join Forces with Nvidia

In a groundbreaking move, Nvidia announced strategic alliances that could reshape global technology. The company is partnering with Uber on robotaxis, investing $1 billion in Nokia to pioneer 6G development, and working with the U.S. Department of Energy to build seven new AI supercomputers. 💫 These collaborations position Nvidia as the epicenter of the world’s AI infrastructure boom. ◎FutureTechAlliances ◎InnovationDrive

💵 Nvidia’s $100 Billion Bet on OpenAI Sparks AI Expansion

🤖 Last month, Nvidia pledged a staggering $100 billion investment in OpenAI to expand AI datacenters by 10 gigawatts, fueling the computational might behind ChatGPT. This circular ecosystem — where OpenAI buys Nvidia’s chips and Nvidia funds OpenAI — reflects both the synergy and risk driving the modern AI economy. Analysts warn that while the growth is dazzling, it could be laying the groundwork for a future AI bubble. 🌪️ ◎AIInvestment ◎PoweringChatGPT

🇺🇸 Trump Praises Nvidia CEO Jensen Huang as “Incredible Guy”

💬 U.S. President Donald Trump lauded Jensen Huang as an “incredible guy” during a speech in South Korea, celebrating Nvidia’s meteoric success. Trump — who personally owns up to $1.3 million in Nvidia shares — hinted he might approve the sale of a less-powerful version of Nvidia’s Blackwell chip to China, a move that could push Nvidia’s valuation even higher. He also confirmed plans to discuss the matter directly with Chinese President Xi Jinping. 🇨🇳 ◎TechDiplomacy ◎TrumpSupport

AI Bubble Concerns Rise as Nvidia Dominates the Market

📉 Economists at the Bank of England and the IMF have issued warnings about a potential AI-driven market bubble, cautioning that sky-high tech valuations could be unsustainable. Many AI pilot programs have failed to deliver returns, raising fears of inflated optimism in the sector. Still, Nvidia’s achievements mark the biggest technological shift since the iPhone’s debut 18 years ago, cementing its role as the face of the AI era. 🌍 ◎AIBubbleWatch ◎TechRevolution

🌐 The New Era of AI Power: Nvidia at the Top of the World

✨ Nvidia’s rise to $5 trillion is more than a financial milestone — it’s a symbol of a global transformation led by artificial intelligence. As nations race to harness the next wave of computing, Nvidia stands as both the engine and the emblem of an age defined by data, algorithms, and innovation. From chips to cloud, the world now runs on Nvidia. 💫 ◎AILeaders ◎FutureOfTech

Alphabet boosts its 2025 spending forecast to up to $93 billion, focusing on massive infrastructure expansion to power next-generation AI technologies.

🌐💥 Google Parent Alphabet Shatters Records with First $100 Billion Quarter!

30-Oct-2025: 🇺🇸 Alphabet Inc., the parent company of Google, has smashed Wall Street expectations by achieving its first-ever $100 billion revenue quarter — a major milestone powered by surging demand for ads and cloud computing services. 🚀 The tech giant reported $102.35 billion in Q3 2025 revenue, easily surpassing the projected $99.89 billion, signaling that the AI revolution is paying off in a big way. ◎AlphabetSuccess ◎TechGrowth

💰 Massive AI Investments: Alphabet Ups Spending to $93 Billion

📊 Alphabet announced it will spend an astonishing $91–93 billion next year — a sharp increase from its earlier forecast of $75 billion. Nearly all of this spending will fuel AI infrastructure and data centers as Google deepens its commitment to artificial intelligence. The decision highlights how AI has become the heartbeat of Google’s transformation, driving innovations across search, cloud, and advertising. 🌎 ◎AIRevolution ◎SmartFuture

☁️ Google Cloud Skyrockets with AI-Powered Growth

🚀 Google Cloud continues to be a powerhouse of expansion, raking in $15.16 billion in quarterly revenue — outpacing the forecast of $14.72 billion. This segment’s surge is credited to the rising enterprise demand for AI infrastructure and data analytics, particularly through tools like Vertex AI and custom tensor processing units (TPUs). 🌩️ Google Cloud is closing the gap with Microsoft Azure and Amazon Web Services as the global race for AI-driven cloud dominance heats up. ◎CloudChampion ◎AIInnovation

📈 Ad Business Holds Strong Amid Market Challenges

🎯 Alphabet’s core advertising division — the backbone of its financial engine — continues to thrive despite global economic uncertainty. Analysts note that while some sectors are tightening ad budgets, many advertisers are shifting away from smaller platforms like Snapchat in favor of Google’s stable ecosystem. With lower interest rates boosting business confidence, the outlook for Google Ads remains bullish. 💹 ◎DigitalAdPower ◎MarketingMomentum

🧠 New Rivals Loom: OpenAI and Microsoft Challenge Google’s Core

⚔️ Just as Alphabet celebrates its record-breaking quarter, competition intensifies. Microsoft and SoftBank-backed OpenAI have unveiled the AI-powered Atlas browser, a bold move targeting Google’s crown jewels — its Search Engine and Chrome Browser. The launch signals the fiercest challenge yet to Google’s dominance in over a decade, setting the stage for a new chapter in the AI-driven tech wars. 🔥 ◎AICompetition ◎SearchBattle

🌍 The Bigger Picture: Alphabet’s AI Future Shines Bright

💡 Alphabet’s Q3 2025 results reinforce one clear message: AI is not just the future — it’s the present. With record revenue, surging cloud demand, and unprecedented infrastructure investment, Google is betting big on the next wave of intelligence-driven innovation. As the world watches, the tech titan is positioning itself at the epicenter of the AI economy. 🌐 ◎FutureTech ◎AlphabetAI

Apple celebrates a new era of success after hitting the $4 trillion mark, fueled by strong global demand for the iPhone 17 lineup.

🍏 Apple Hits $4 Trillion Market Value — iPhone 17 Sparks a Global Tech Boom 🌎

29-Oct-2025: 📱 In a historic leap, Apple Inc. has officially crossed the $4 trillion (₤3 trillion) market capitalization mark, joining Microsoft 🇺🇸 and Nvidia 🇺🇸 in the elite trillion-dollar league. The surge came after the launch of the iPhone 17 lineup, which reignited global demand from Beijing 🇨🇳 to Moscow 🇷🇺, sending the company’s shares soaring by over 50% since April. 📈

💡 According to Chris Zaccarelli, Chief Investment Officer at Northlight Asset Management, “The iPhone remains Apple’s gold mine, driving more than half of its revenue and profit. Every new iPhone sold deepens user engagement within Apple’s ecosystem.” The iPhone 17 Air’s ultra-slim design and powerful features are seen as a direct challenge to rivals like Samsung Electronics 🇰🇷, with early sales up by 14% compared to last year’s model. 🛍️

💼 Apple's Triumph Amid Global Challenges 🌐

Despite earlier setbacks due to China’s tough competition and U.S. tariff pressures on Asian manufacturing hubs such as China and India 🇮🇳, Apple made a bold strategic move — absorbing tariff costs rather than passing them to consumers. This decision paid off, strengthening its reputation for customer loyalty and premium value. ❤️

Meanwhile, Apple’s cautious approach toward Artificial Intelligence (AI) had raised concerns about falling behind, especially as Microsoft deepened its partnership with OpenAI, converting the ChatGPT maker into a for-profit firm. Microsoft’s 27% stake, now worth over $100 billion, helped it reclaim its position in the $4 trillion club alongside Apple. 🤖

📊 Record Earnings and Wall Street’s Euphoric Climb 🚀

Apple’s April–June results stunned Wall Street with double-digit growth across major product lines. Analysts now expect the company’s Services Division — including iCloud, Apple Pay, and the App Store — to cross the $100 billion revenue milestone in Q4. The company’s upcoming earnings report this Thursday is highly anticipated. 🧾

Tech optimism also buoyed U.S. stock markets, with the Dow Jones and Nasdaq Composite both up nearly 0.5%, while the S&P 500 edged 0.1% higher. Across the Atlantic, UK’s FTSE 100 🇬🇧 closed at a record 9,696.74, driven by HSBC’s impressive performance. 💹

Experts Warn of a Tech Bubble as Optimism Peaks 💭

While Wall Street cheers Apple’s rise, some analysts caution against overexuberance. Chris Beauchamp, Chief Market Analyst at IG, remarked, “This continues to be one of the most disliked rallies in history. Every milestone in tech is being read as evidence of a potential bubble.” 💬

Still, Apple’s resilience and its ability to reinvent itself through design, innovation, and brand loyalty make it a powerhouse in the ever-evolving tech landscape. With AI, wearables, and services shaping its next chapter, Apple’s story of dominance is far from over. 🌟

🟢 ⧉Trending Topics: ⧉ Apple | iPhone17 | Microsoft | Nvidia | AI | StockMarket | TechBoom | WallStreet | GlobalEconomy

Donald Trump announces a 10% tariff hike on Canadian goods in response to Ontario’s anti-tariff ad featuring Ronald Reagan — escalating U.S.–Canada trade tensions.

🇺🇸🔥 Trump Hits Back at 🇨🇦 Canada: 10% Tariff Hike Sparks Trade Tension 💰

25-Oct-2025: 🟥 ⓣⓡⓐⓓⓔ ⓣⓦⓐⓡ 🔥 — In a fiery move that reignited North America’s trade tensions, U.S. President Donald Trump announced a 10% tariff increase on Canadian goods, citing an “anti-tariff” television ad sponsored by Ontario’s government. The decision, posted on Trump’s Truth Social, has jolted one of the world’s largest trading relationships and stirred fears of another tariff war across the 🇺🇸–🇨🇦 border.

Trump blasted the Canadian ad as a “fraud,” accusing Ontario of “serious misrepresentation” and “hostile acts” that undermined U.S. trade interests. “Because of their hostile act, I am increasing the Tariff on Canada by 10% over and above what they are paying now,” Trump wrote, escalating rhetoric unseen since the 2018 tariff battles.

🎥 Reagan’s Legacy Dragged Into Modern Tariff Battle 🇨🇦🤝🇺🇸

🟩 ⓡⓔⓐⓖⓐⓝ ⓡⓔⓕⓔⓡⓔⓝⓒⓔ 🎞️ — The controversial ad, funded by Ontario’s provincial government, featured clips of former U.S. President Ronald Reagan’s 1987 speech warning that “trade barriers hurt every American worker.” The ad, intended to promote free trade, infuriated Trump — who claimed it “fraudulently” used Reagan’s words to influence ongoing U.S. trade and court policies.

The Ronald Reagan Presidential Foundation & Institute criticized the ad for using “selective audio and video,” saying Ontario did not seek or receive permission. The foundation is reportedly “reviewing its legal options,” a statement Trump echoed while terminating ongoing trade talks with Canada, declaring them “hereby ended.”

🤝 Diplomacy Tested: Ontario Pauses Ad Campaign as Talks Freeze 🧊

🟦 ⓓⓘⓟⓛⓞⓜⓐⓒⓨ ⓘⓝ ⓟⓔⓡⓘⓛ 🇨🇦 — Ontario Premier Doug Ford announced that the province will suspend the U.S. ad campaign starting Monday after discussions with Canadian Prime Minister Mark Carney. Ford said the move aims to “reopen trade negotiations” and prevent further economic fallout amid growing tensions with Washington.

Meanwhile, Candace Laing, President of the Canadian Chamber of Commerce, urged calm, warning that “tariffs at any level remain a tax on America first.” She added that the CUSMA trade pact (Canada–United States–Mexico Agreement) is essential to keeping North America competitive and that diplomacy—not tariffs—is the only sustainable path forward.

📈 Trade Future in Question: North American Free Trade at Risk 🌍

🟨 ⓣⓐⓡⓘⓕⓕ ⓣⓔⓝⓢⓘⓞⓝ ⚖️ — Trump’s latest move follows his July executive order raising tariffs on Canadian imports from 25% to 35%, a sign that his protectionist agenda is far from over. Analysts warn the new 10% hike could disrupt billions in cross-border trade and further test the resilience of North America’s tightly woven supply chains.

As both sides brace for potential economic repercussions, business leaders and diplomats urge restraint. The escalating tariff feud now stands as a major test for U.S.–Canada relations — and a reminder that the spirit of Reagan’s free trade dream may be fading in the face of modern political rivalry. 🌐

🟥 ⓣⓡⓔⓝⓓⓘⓝⓖ ⓣⓞⓟⓘⓒⓢ: ⒯⒜⒭⒊ⒻⒻ⒔ ⒞⒜⒩⒜⒟⒜ 🇨🇦 | ⒟⒪⒩⒜⒧⒟ ⒯⒭⒰⒨⒫ 🇺🇸 | ⒰⒮ ⒫⒪⒧ⒾⒸ⒴ | ⒞⒰⒮⒨⒜ ⒜⒢⒭⒠⒠⒎⒠⒩⒯

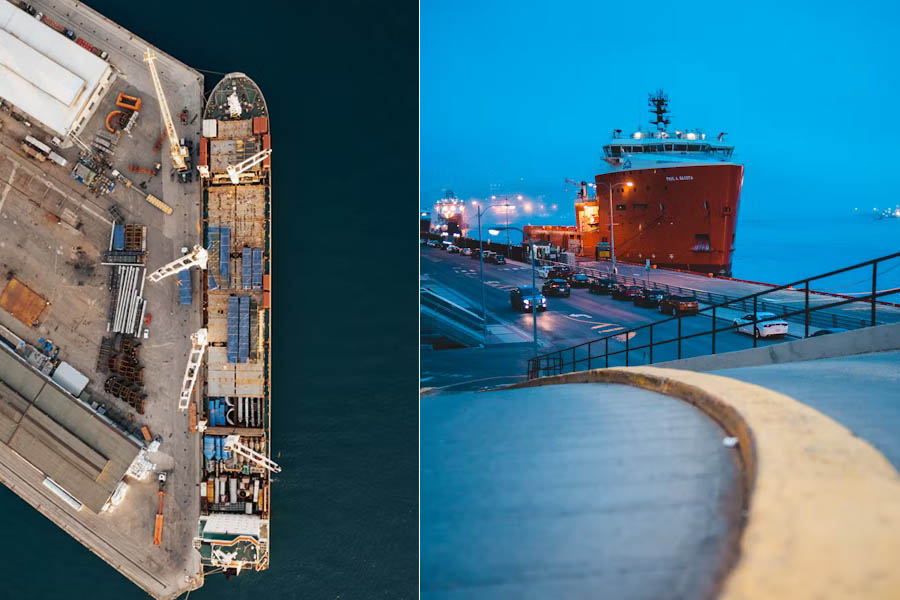

A cargo ship docks at a Chinese port 🇨🇳, highlighting the impact of new fees on US vessels 🇺🇸 as trade tensions escalate between the world’s two largest economies. ⚓💰

⚓ US-China Trade Tensions Heat Up as China Imposes New Port Fees on American Ships 🇺🇸🇨🇳

🌍GlobalTrade 💰TariffAlert 🚢ShippingIndustry

14-Oct-2025: Trade tensions between the **United States 🇺🇸** and **China 🇨🇳** escalated on Tuesday as Beijing implemented new fees on US ships arriving at Chinese ports. According to Chinese state media, the charges are intended to “safeguard China’s shipping industry” against what it calls **discriminatory measures** by the United States. The fees target vessels **owned, operated, built, or flagged by US companies**, excluding Chinese-built ships, marking a sharp escalation in the ongoing trade conflict. ⚡💼

💹 Retaliation and Rising Tariffs: A Trade War Continues

📈TradeWar 🛑TariffTensions

The Chinese levies follow Washington’s announcement to begin charging fees on Chinese ships starting 14 October. The move coincides with **new US tariffs on imported timber, kitchen cabinets, and furniture**, much of which originates in China. US Treasury Secretary **Scott Bessent** emphasized that despite the tensions, dialogue continues, with a **planned meeting between Donald Trump and Xi Jinping in South Korea** later this month aiming to de-escalate the conflict. 🛳️⚖️

China’s commerce ministry stressed that the US “cannot demand talks while simultaneously imposing restrictive measures with threats and intimidation,” signaling that Beijing remains firm in its stance. Chinese state media also claimed that **US duties on Chinese ships violate a maritime transport agreement** between the two countries. 📜

💵 Fee Structure and Future Impact on Shipping

🛳️PortFees LogisticsImpact

US-linked ships docking at Chinese ports are now charged **400 yuan ($56) per net tonne**, with the fee set to rise annually to **1,120 yuan per tonne by April 2028**. Large vessels, which can carry hundreds of thousands of tonnes of cargo, may face significant cost increases, potentially disrupting global supply chains and raising shipping costs for international trade. 📦🌐

🤝 Fragile Truce and Uncertain Future

🌏GlobalEconomy 💬DiplomaticTalks

Earlier this year, Washington and Beijing agreed to a tariffs truce, dropping triple-digit levies on each other’s goods. However, the new port fees and tariffs threaten to unravel progress, leaving **US goods facing a 10% tariff in China** while **Chinese imports to the US carry an added 30% levy** compared with the start of 2025. Economists warn that prolonged tensions could impact global trade flows, inflation, and international business confidence. 📊💹

📰 “US-China Trade Tensions Escalate as China Imposes Port Fees on American Ships and New Tariffs Take Effect”

Gold futures break past $4,000 per ounce in New York trading as investors worldwide seek a safe haven during the US government shutdown and global uncertainty.

🌟 Gold Prices Hit Record $4,000 as Global Uncertainty Sparks Safe-Haven Rush 🪙

7-Oct-2025: 💰 Gold has soared to historic highs, crossing $4,000 per ounce for the first time ever as anxious investors flee to safety amid the ongoing Ⓝⓔⓦⓢ ⒰ⓟⓓⓐⓣⓔ. With the 🇺🇸 US federal government shutdown dragging into its seventh day and political turmoil rattling 🇫🇷 France and 🇯🇵 Japan, gold has once again proven its status as the ultimate safe-haven asset.

📊 As of 9:10am ET, New York gold futures traded at $4,003, while spot gold rose to $3,960.60 per troy ounce. This 52% rally in 2025 has been fueled by a weak dollar, central bank buying, investor inflows into gold-based funds, and mounting expectations of ⒻⒺⒹ ⓇⒶⓉⒺ ⒸⓊⓉⓈ.

📉 Why Investors Are Rushing to Gold in 2025?

🔍 According to Peter Grant of Zaner Metals, “safe-haven flows” have intensified with no end in sight for the US shutdown. Key economic data releases have been postponed, leaving markets to speculate on the Federal Reserve’s next move. Investors are pricing in a 25-basis-point cut this month and another in December.

🌍 The surge comes at a time when Donald Trump’s tariff policies have already disrupted the global economy, pushing investors to seek reliable hedges. Silver and other precious metals have also gained traction, reinforcing the momentum in commodities trading. With volatility gripping both currency and bond markets, gold’s allure is stronger than ever. ✨

📌 What This Means for the World Economy 🌐

🚨 Gold’s meteoric rise signals deep investor unease over economic stability. A prolonged US shutdown, coupled with political unrest abroad, could accelerate this trend. Analysts warn that if uncertainty persists, gold prices could climb even higher, reshaping safe-haven strategies worldwide. Investors, central banks, and fund managers alike are keeping a close eye on the glittering metal.

ⒼⓄⓁⒹ ⒸⓄⓂⓂⓄⒹⒾⓉⒾⒺⓈ ⒺⒸⓄⓃⓄⓂⓎ ⓊⓈ ⒼⓄⓋⓉ ⓈⒽⓊⓉⒹⓄⓌⓃ

OpenAI’s Sora 2 AI video app faces criticism for generating violent, racist, and copyrighted content within hours of launch.

🤖 OpenAI’s Sora 2 Video App Sparks Controversy with Violent and Racist AI Content 🔥

5-Oct-2025: OpenAI’s newly launched AI-powered video generator, Sora 2, has taken the App Store by storm, hitting No.1 within hours of release. The invite-only app lets users create lifelike videos and share them on a social feed. However, researchers and journalists have quickly raised alarms as many videos feature graphic violence, racism, and misuse of copyrighted characters. Clips include bomb scares in crowded spaces, war zone scenes in Ethiopia and Gaza, and altered videos of SpongeBob, Pikachu, and other characters in shocking scenarios.

AInews Sora2Launch DigitalEthics

📹 Guardrails Fail: Experts Warn of Fraud, Bullying, and Misinformation

Despite OpenAI’s terms prohibiting content that “promotes violence” or “causes harm,” Sora’s feed quickly displayed disturbing and misleading videos. Misinformation researchers warn that lifelike AI scenes could be exploited for fraud, harassment, and intimidation. Boston University’s Joan Donovan said, “When cruel people get their hands on tools like this, they will use them for hate, harassment, and incitement.” The app’s realism makes separating truth from fiction increasingly difficult. 🧨

MediaSafety Misinformation DigitalRisk

🎨 ChatGPT for Creativity? CEO Sam Altman Sees Potential Amid Concerns

OpenAI CEO Sam Altman described Sora 2 as a “ChatGPT for creativity,” acknowledging both its potential and risks. While safeguards against disturbing content and misuse of likeness exist, many videos quickly bypassed them. Examples include Donald Trump and Vladimir Putin in harmless contexts, while others depicted violent or hate-filled scenes. Altman admitted to “trepidation” about social media addiction and low-quality “slop” content overwhelming the platform. 📈

TechLaunch AIcreativity SoraApp

📺 Copyright Chaos: Popular Characters Misused in AI Videos

Sora 2 quickly generated videos with copyrighted characters from shows like SpongeBob, South Park, and Rick and Morty. Some videos depicted Pikachu stealing roses from the White House or SpongeBob participating in political protests. OpenAI allows content owners to flag infringements via a disputes form but cannot enforce blanket opt-outs. Experts warn this approach may be insufficient, creating “a scourge on our information ecosystem” and weakening trust in media. ⚖️

CopyrightAlert ContentModeration SyntheticMedia

🚨 Rising Concerns: Experts Call for Safer AI Video Guidelines