Chinese investors, particularly the affluent, are moving unprecedented amounts of capital out of the country, reflecting concerns about the economic and political future. This capital flight, facilitated by the easing of COVID-19 travel restrictions, is reshaping global real estate markets and financial landscapes. In this article, we delve into the driving factors behind this trend and its implications.

Post-COVID Surge in Capital Outflow:

The lifting of COVID-19 restrictions has led to a surge in outbound investments by affluent Chinese individuals and private-sector companies.

Investments include purchases of overseas real estate, stocks, and insurance policies, signaling a diversification of assets beyond China's borders.

Economic Concerns and Real Estate Slowdown:

Capital outflow suggests unease within China regarding the post-pandemic economic recovery and concerns about the real estate market, a significant source of wealth for Chinese families.

The alarming slowdown in real estate, coupled with government interventions under Xi Jinping's leadership, has prompted investors to seek safer havens abroad.

Improvising to Bypass Controls:

Chinese investors are finding creative ways to bypass strict government controls on capital transfer, such as purchasing gold bars small enough to be discreetly carried or acquiring stacks of foreign currency.

Real estate transactions, particularly in global hubs like Tokyo, involve significant cash transactions, reflecting a desire for anonymity.

Government Response and Currency Weakening:

Despite large-scale capital outflows, the Chinese government maintains control through measures to manage the situation.

The outflow has weakened the Chinese currency (renminbi) against the dollar, contributing to sustained export competitiveness and supporting millions of jobs.

Potential Economic Impact:

While the current pace of capital outflow may not pose an immediate risk to China's $17 trillion economy, continued large-scale movement of savings abroad could have broader implications.

Historical examples highlight the potential for financial crises triggered by significant capital outflows.

Government Controls and Management:

Chinese policymakers, drawing from lessons of previous currency crises, are implementing controls to manage the situation.

Current efforts include limits on overseas money transfers and monitoring schemes to prevent disguised international transfers.

Mixed Response from Investors:

Global investors and experts offer mixed perspectives on the impact of China's capital outflow on global markets.

While the Chinese government asserts control, investors remain vigilant, considering potential risks associated with the significant movement of capital.

The surge of capital outflow from China reflects a complex interplay of economic, political, and global factors. As Chinese investors seek to diversify their assets and navigate uncertainties within the country, the implications for both China and the global financial landscape are profound. Monitoring these trends will be crucial for investors, policymakers, and analysts alike.

A recurrent theme among Democratic voters is the perception of increasing corporate power and a squeezed middle class. Calls for addressing income inequality, raising the minimum wage, and tax reforms reflect a desire for a more equitable society.

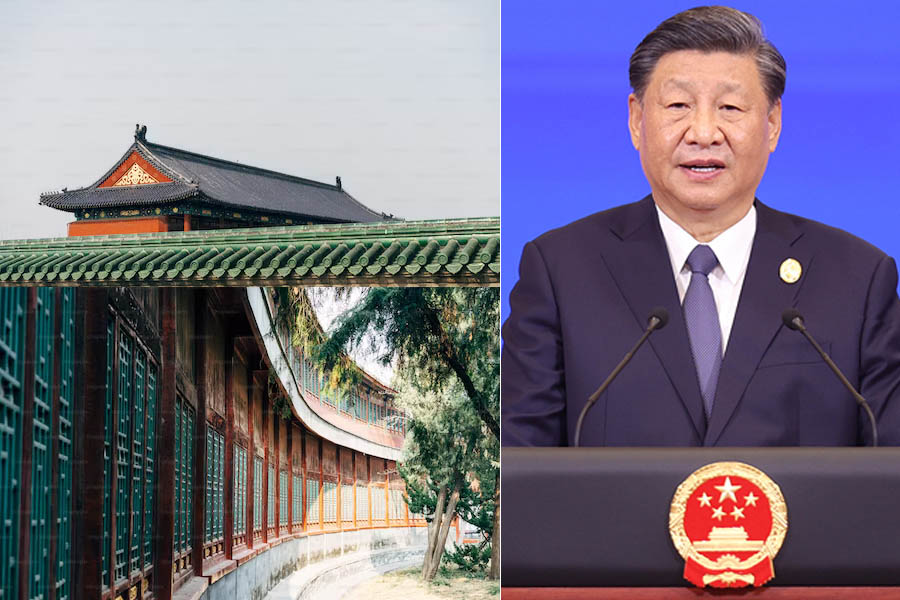

Chinese President Xi Jinping's recent visit to Shanghai, accompanied by a slew of economic reforms, marks a significant effort to reverse the massive capital flight that has plagued China. The proposed reforms aim to boost the private sector, attract foreign investments, and address concerns about the intertwining of state and private interests. In this article, we delve into the intricacies of Xi's reform agenda and its potential impact on China's economic landscape.

Boosting the Private Sector:

Xi's visit to Shanghai is not merely a symbolic gesture but a strategic move to rejuvenate China's private sector. The announced reforms focus on leveling the playing field for private enterprises, which have faced challenges and a loss of investor confidence in the wake of government interventions and the fallout from the COVID-19 pandemic.

Reforms as a Response to Economic Challenges:

The economic challenges facing China, including the deflationary fears, a property crisis, and a stalling economic recovery, have prompted Xi's administration to kickstart the economic stimulus machine. The People's Bank of China has injected liquidity into troubled property developers, signaling a commitment to stabilize critical sectors.

Rebuilding Investor Confidence:

Over $1 trillion of foreign capital fled mainland share markets following Xi's crackdown on Big Tech in 2020. The proposed reforms aim to restore investor confidence by creating a more conducive environment for both domestic and foreign investors. Analysts, such as Zerlina Zeng at CreditSights, anticipate a positive shift in China's external stance and its relationship with developed markets.

Key Reforms and Areas of Focus:

The reform package, involving 25 steps, is designed to increase the role of the private sector in various industries. Key areas of focus include:

Ailing Property Market: Addressing debt strains from property developers and local government financing vehicles.

Financial Services Access: Setting transparent targets to widen access to financial services for private enterprises.

Technological Innovation: Supporting innovation in small and medium-sized enterprises, green and low-carbon initiatives, and disruptive technologies.

Balancing Risk and Development:

The reforms emphasize a greater tolerance for risk-taking, allowing startups to take on non-performing loans. Beijing aims to recalibrate lending and borrowing practices to foster private sector development while minimizing associated risks.

The Challenge of Blurred Lines:

The complexity of China's corporate landscape is highlighted by the blurred lines between state and private entities. The "mixed-ownership reform" initiated in 2013, intended to introduce private capital into state firms, has often resulted in state companies taking control of private enterprises. Recent investments and stake acquisitions indicate a significant shift of control toward state entities.

The Rise of Party-State Capitalism:

China's evolving economic model is moving from state capitalism, where business is guided by national interests, toward "party-state capitalism." The influence of the Communist Party on corporate decisions has become more pronounced under Xi's leadership.

Challenges and Distrust:

The intertwining of political ideology and corporate decision-making, evident in mechanisms like the corporate "social credit" system and party committees, has created distrust among foreign investors. The challenges of navigating this complex system are not limited to external observers but extend to entrepreneurs attempting to balance commercial activities with political loyalty.

As Xi Jinping pushes for extensive reforms to revitalize China's private sector and address economic challenges, the delicate balance between party influence and economic development remains a central concern. Observers and market participants will be closely monitoring the outcomes and navigating the evolving landscape of Chinese capital flow and corporate governance.