In the fast-paced world of artificial intelligence (AI), pushing the boundaries of what is possible is more crucial than ever. Just two years after OpenAI’s ChatGPT took the tech industry by storm, the development of generative AI has hit some formidable obstacles. Rising energy costs, scalability challenges, and the complexities of building more advanced models are slowing progress. Yet, history has shown that constraints often lead to remarkable innovation. The race to surpass these barriers is not just shaping the future of AI—it’s also laying the groundwork for new leaders in technology, investment, and geopolitical power.

The Energy Conundrum: AI’s Growing Appetite

One of the most pressing issues facing AI is its insatiable hunger for energy. Large language models (LLMs) like OpenAI’s GPT-4 require massive amounts of power to train. For perspective, the energy used to train GPT-4 could have powered 50 American households for an entire century. As these models grow in complexity, the costs skyrocket. Estimates suggest training today’s largest models costs upwards of $100 million, with future projections reaching an astronomical $1 billion—and potentially $10 billion—for the next generation.

But training is just the beginning. Running these models, or inference, adds another layer of computational demands. Take, for instance, a seemingly simple task like summarizing financial reports for all public companies: the cost per request could range from $2,400 to a staggering $223,000. With such high figures, the question arises: Can AI remain economically viable at this scale?

Example: The Financial Costs of AI Models

Consider how Google’s PaLM 2 model, a state-of-the-art LLM, is grappling with the same issue. In an experiment designed to test its capabilities, researchers found that running complex queries across large datasets resulted in energy costs that far exceeded initial expectations. This example underscores the challenge of keeping AI both cutting-edge and affordable.

Investor Concerns: A High-Stakes Bet

The financial stakes of AI's future are immense. Nvidia, a dominant provider of AI chips, has seen its market value soar by $2.5 trillion in just two years. Meanwhile, venture capitalists have funneled $95 billion into AI startups in the first half of 2023 alone. OpenAI is currently eyeing a $150 billion valuation, putting it among the world’s largest private tech companies.

However, towering valuations come with equally high expectations, and some investors are growing wary of the sustainability of these ventures. As energy and operational costs rise, so too do the risks associated with AI’s long-term economic feasibility.

Interesting Note: Investor Trends and AI Startups

A notable shift in investment strategies has seen an increasing focus on AI startups offering more specialized, energy-efficient solutions. For example, companies like Cerebras Systems and Graphcore are developing AI chips tailored to specific workloads, aiming to reduce the massive energy footprint of general-purpose processors.

A History of Innovation in the Face of Limits

Despite these challenges, the story of technological advancement often features moments of constraint that spark innovation. During the 1970s oil crisis, rising fuel prices forced engineers to develop more energy-efficient cars and explore alternative energy sources. Similarly, AI’s current energy and scalability challenges are prompting fresh ideas and breakthroughs that could reshape the field.

For instance, research into neuromorphic computing—a type of computing that mimics the human brain's neural networks—could lead to AI models that are more efficient and less power-hungry. This approach has the potential to radically alter the AI landscape, making it possible to train and deploy models with significantly lower energy consumption.

The Road Ahead: Hardware and Software Evolution

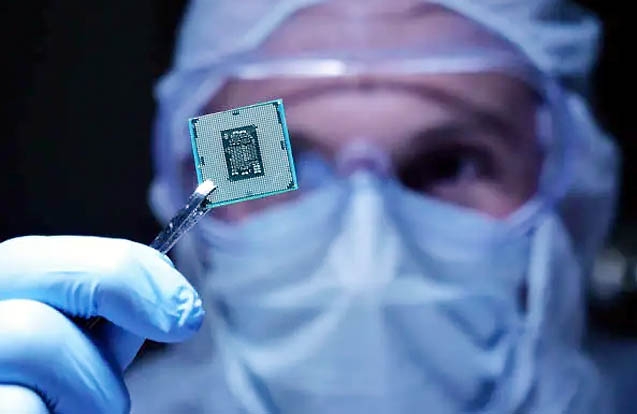

To address these issues, industry leaders are developing more specialized hardware and smarter software solutions. Tech giants like Alphabet, Apple, and Microsoft are pouring resources into creating AI-specific chips designed to process tasks more efficiently than traditional CPUs. In fact, the first half of 2024 saw AI chip startup investment surpass the total of the previous three years combined.

This hardware innovation is being matched by advancements in software. OpenAI’s latest model, called "O1," is designed with a focus on reasoning over text generation, which reduces its computational needs. Other AI models are adopting algorithms that prioritize efficiency, using specialized techniques that allow them to perform tasks with fewer resources.

Example: Meta's Custom AI Chips

Meta (formerly Facebook) recently unveiled its custom-built AI chip designed specifically for AI workloads. These chips not only accelerate the training of large models but also cut down energy usage significantly, marking a new era in the hardware-software integration of AI.

Winners and Losers: The Shifting Competitive Landscape

The assumption that current AI giants, such as Nvidia and OpenAI, will continue to dominate the space is being called into question. Companies focusing on specialized AI applications are closing the gap. Google and Anthropic, for instance, are rapidly improving their models, while European startups are developing niche AI solutions that challenge the dominance of the major players.

As smaller, more specialized models gain traction, the AI market could become more fragmented. Companies targeting specific use cases—whether in healthcare, finance, or logistics—may begin to dominate their respective industries, reducing the overall influence of current AI leaders.

Interesting Note: Rise of Specialized AI

Startups like Cohere and Stability AI are gaining attention for their focus on specialized natural language processing (NLP) models that require significantly less energy to train and operate, yet deliver cutting-edge performance in their chosen fields. This specialization is seen as a key factor in AI’s next phase of growth.

Implications for Investors and Governments

For investors, the road ahead is uncertain. The AI market, once expected to be dominated by a few major players, is becoming increasingly unpredictable. Governments will also need to adjust their strategies, especially when it comes to fostering innovation and managing talent.

For example, while the U.S. remains a leader in AI due to its concentration of world-class universities and research hubs, its efforts to restrict China’s access to advanced technology could backfire. Chinese researchers are increasingly finding ways to innovate around these restrictions, developing new AI models and techniques that don’t rely on U.S. technology.

Unleashing AI’s True Potential

Despite the challenges, the future of AI is bright. History has shown that human ingenuity flourishes under constraints, and the current barriers facing AI are no different. For the U.S. and other nations looking to maintain their leadership in the field, the key will lie in fostering global talent, supporting innovation ecosystems, and adapting quickly to new technological realities.

As AI continues to evolve, the breakthroughs that will define the next era are on the horizon—waiting to be unleashed.

#AIInnovation 🚀 #NextGenTech 🔮 #GenerativeAI 🧠 #TechChallenges 💡 #AIRevolution 🤖 #FutureOfAI 🌟 #TechInvestments 💼 #AIResearch 🔬 #ScalableAI 📈 #EnergyEfficiency ⚡ #TechDisruption 💥

Thank you for reading: globalpostheadline.com